- Regulated in five jurisdictions

- Offers access to MetaTrader 4 and MetaTrader 5

- Charges no deposit fees

- Offers access to over 2,200 trading instruments

- Fast and digital account opening/verification

- Superb customer support

- Wide range of account types

- Extensive educational material

- Charges inactivity fee of 5 EUR/USD/GBP per month after 6 months of inactivity.

- Charges a $3 withdrawal fee when using a debit/credit card

- High spreads

FXTM is a global online broker founded in 2011. The broker operates in more than 150 countries and serves more than 4 million clients. The company offers access to various financial instruments including FX pairs, commodities, metals, stocks, stock CFDs, indices, and stock baskets.

FXTM is regulated and authorized in various jurisdictions and therefore considered safe. The list of regulators includes the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA), the Financial Conduct Authority (FCA), the Capital Markets Authority of the Republic of Kenya, and the Financial Services Commission of the Republic of Mauritius.

It should be noted that the FXTM broker does not register accounts from the USA, Mauritius, Japan, Canada, Haiti, Iran, Suriname, Korea, Puerto Rico, Brazil, Hong Kong, and the Occupied area of Cyprus.

FXTM Overview

| Regulations | Cyprus, Kenya, Mauritius, South Africa, UK |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 5 EUR/USD/GBP per month after 6 months of inactivity |

| Minimum deposit | 10 USD. 500 USD/EUR/GBP or 80,000 NRN for Advantage and Advantage Plus accounts |

| Minimum account activation | 10 USD |

| Number of available assets | 2,200+ |

| Leverage up to | 1:2000 |

| Available trading markets | CFDs on Stocks, Commodities, Forex, Indices |

| Account currencies | EUR, USD, GBP, NGN |

| Demo account | Yes |

| Live account types | Micro, Advantage, Advantage Plus |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 60 |

| Shares | 1307 |

| Cryptocurrencies | 0 |

| Indices | 17 |

| Commodities | 8 |

| Total | 2,200+ |

| Fees & spread | |

| Forex | From 0. From 1.5 pips on Micro and Advantage Plus accounts |

| Shares | From 1 pips. US shares are taxed by 30% dividend tax |

| Cryptocurrencies | N/A |

| Indices | From 0 |

| Commodities | From 0. Spreads on Gold vs USD start from 0 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Credit/Debit Card, GlobePay, Google Pay, Neteller, PayRedeem, Perfect Money, Skrill |

| Minimum deposit | Bank Transfer, Credit/Debit Card, GlobePay, Google Pay, Neteller, PayRedeem, Perfect Money, Skrill |

| Minimum withdrawal | Bank Transfer, Credit/Debit Card, GlobePay, Google Pay, Neteller, PayRedeem, Perfect Money, Skrill |

| Withdrawal processing time | Instant |

| Time to open an account | – |

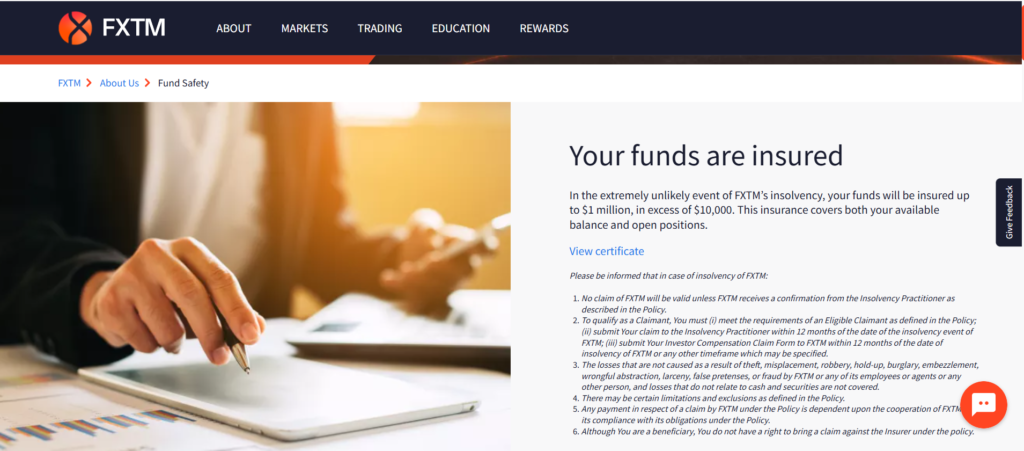

Safety & Security

Trading financial assets are associated with risks. In order to reduce the risks as a retail trader, the number one feature you should look for in a broker is safety and security.

There are a couple of indications that can help you tell whether your broker is trustworthy or not. The first and foremost is regulations. Financial regulators have policies that are designed and put in place to protect traders’ interests. FXTM is regulated by a top-tier regulator, namely the Financial Conduct Authority of the UK. The regulator has one of the strictest license requirements out there.

Among the regulatory bodies that have licensed FXTM are:

- Cyprus Securities and Exchange Commission (CySEC),

- Financial Sector Conduct Authority (FSCA),

- Financial Conduct Authority (FCA),

- the Capital Markets Authority of the Republic of Kenya,

- Financial Services Commission of the Republic of Mauritius.

Policies

FXTM keeps the funds deposited by its clients in segregated bank accounts. Making the funds inaccessible for the broker’s day-to-day business operations, which increases the level of safety. What’s more, FXTM is a part of the Financial Commission’s Compensation Fund. The Compensation Fund is dedicated to resolving disputes between the financial services industry and the market. Moreover, FXTM provides negative balance protection, which acts as insurance. Traders will never lose more money than the invested amount. Forex trading is a highly leveraged business that creates possible scenarios for losing more money than is on your trading balance. When you are trading with a broker who does not offer negative balance protection, in case your funds go negative due to high leverage and volatility, you will owe the outstanding money to your broker.

In order to provide negative balance protection policies, brokers use Stop Out levels. Stop Out levels are predetermined margin percentages where the broker automatically closes open positions to prevent further losses. FXTM offers different Stop Out levels for its various account types. For instance, Micro accounts offer a 40% Stop Out level. Whereas Advantage and Advantage Plus accounts have a 50% Stop Out level. It’s important to take into consideration the automatic Stop Out percentage when you are placing orders, as you might be able to find a great trading setup and get closed out from an active trade due to high leverage.

Trading Assets

FXTM offers various asset classes for trading. The total number of instruments you can trade is more than 2,200. However, it must be noted that the number of available assets varies for different account types. In addition, you can trade more stocks and stock CFDs using the MetaTrader 5 platform. MetaTrader 4 is generally only used for trading currency pairs.

Forex trading

The Forex broker provides access to trading 19 Major pairs such as AUD/JPY, AUD/USD, EUR/USD, USD/CAD, USD/JPY, and more. Major currency pairs are backed by strong economies and are more stable compared to exotic currencies. Retail traders, institutional traders, governments, international companies, and banks are exchanging more major currencies than exotic ones in the Forex market. As a result, liquidity is increased and spreads (spread is a difference between the bid and the ask price) are decreased. It’s best for novice traders to avoid trading exotic pairs due to low liquidity. FXTM offers 17 exotic pairs including CHF/NOK, EUR/HKD, GBP/PLN, EUR/TRY, USD/CZK, etc. In addition, you can trade up to 22 minor pairs which include CAD/JPY, EUR/NZD, AUD/CAD, and EUR/RUB, USD/RUB.

Leverage for trading FX pairs using Advantage and Advantage Plus accounts is up to 2000:1. As for the Micro account, traders get 1000:1 leverage. Keep in mind that leverage can help you make more money from smaller price moves on the chart, but it can also increase your losses. Therefore, you should choose the leverage carefully. Strict regulators prevent brokers from offering high leverage.

The minimum initial deposit required for opening a Micro account is only $10. Which is pretty reasonable. On the other hand, spreads start from 1.5 pips on the Micro account. Most Forex brokers offer lower spreads and trading-related fees than FXTM.

Shares trading

The broker gives access to trading 646 US shares to Its clients. The list of companies includes AIRBNB, ALPHABET-A, ALIGN-TECHNOLOGY, AMAZON, and many more. In addition to US stocks, investors get access to Kenyan shares that includes BAMBURI CEMENT, EAST AFRICAN BRE, EQUITY GROUP HOL, KENIA ELECTRIC, and more.

In addition, there are 644 single stocks available from the Hong Kong Stock Exchange. Moreover, you can also trade 17 Kenyan company stocks. Keep in mind that FXTM only offers trading real stocks using Advantage and Advantage Plus accounts and the minimum initial deposit to open these accounts is 500 EUR, USD, or GBP depending on your account currency. Traders can also fund their accounts using Nigerian naira starting from 80,000 NGN. Furthermore, trading real stocks are available from the MetaTrader 5 platform and US stocks are taxed in accordance with the US government rules and regulations, which is 30% of the dividend amount.

Stock CFD trading

As already mentioned, stock CFD trading is preferred by many short-term traders due to lower trading fees and accessibility. What’s more, stock trading has certain benefits over currency trading. Stocks move very differently than currencies do. Some traders succeed in trading stocks while failing in trading currencies and vice versa. As a beginner trader, it’s important to try out different markets to get an idea of what works best for you.

With FXTM you have access to 764 US stock CFDs and 50 European stock CFDs. What’s more, leverage for American stocks goes up to 10:1, whereas for European stocks leverage maxes out at 3:1. Spreads for trading stock CFDs start from 0 pips. When trading stock CFDs, traders have the ability to buy and sell assets and get revenue from markets moving up or down. Whereas in order to benefit from trading real stocks, investors buy when prices are down to acquire the assets and sell when the prices increase.

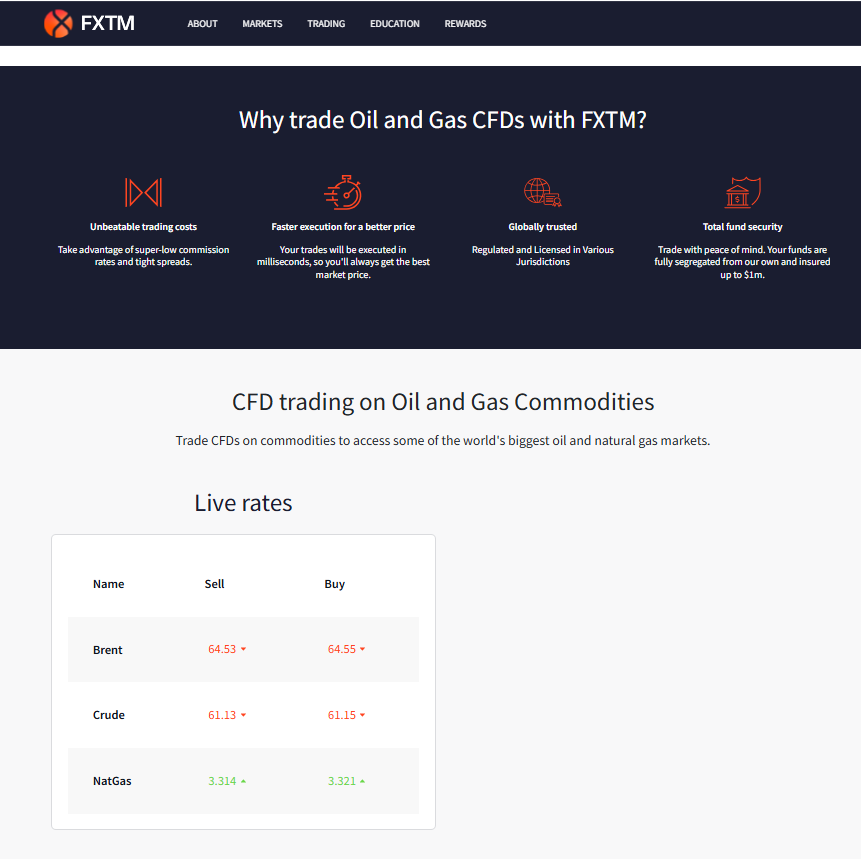

Commodity trading

Commodities are raw materials. There are numerous ways you can invest in them. You can buy or sell physical metals, trade commodity CFDs, or invest in companies that mine or grow commodities.

FXTM gives you access to trading 5 metal vs currency pairs including XAG/EUR (Silver vs Euro), XAG/USD (Silver vs US Dollar), XAU/EUR (Gold vs Euro), XAU/GBP (Gold vs British Pound) and XAU/USD (Gold vs US Dollar). Commodities such as gold and silver are used as a hedge against inflation by many investors. Metal prices are characterized by low volatility, therefore risks and rewards associated with investing in metals are generally low.

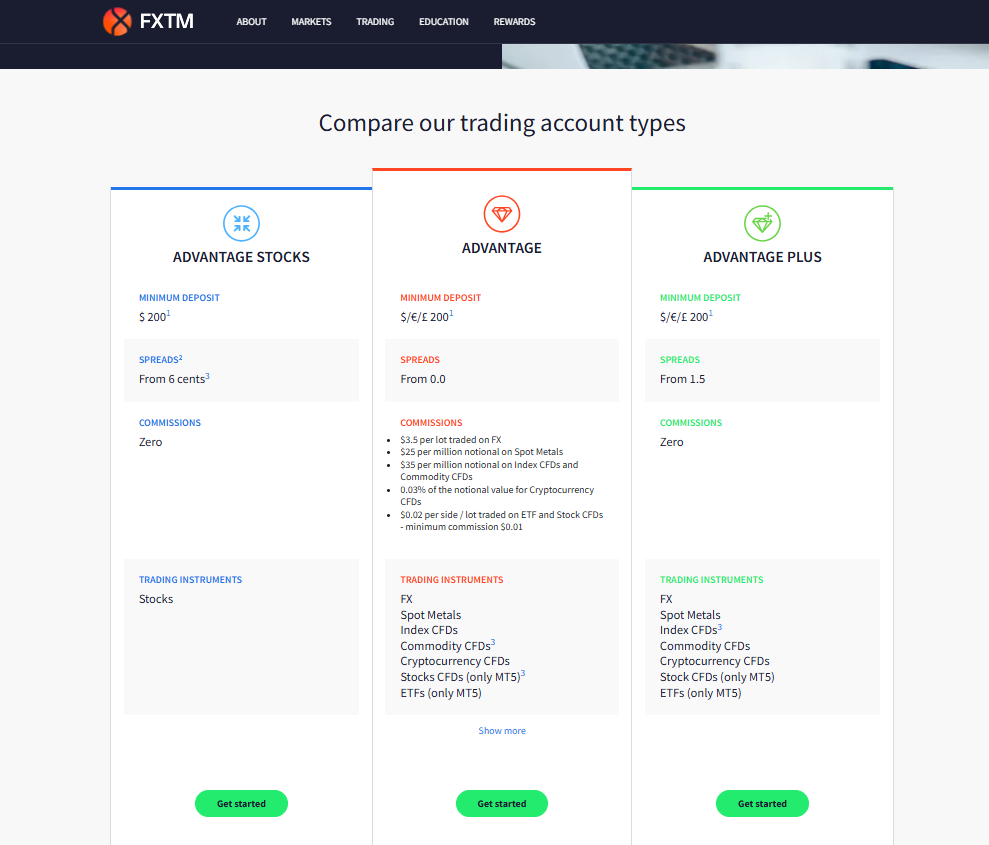

Account Types

There are various types of traders in the markets. Some trade intraday to avoid swaps. Some like position trading and giving a longer time to see if their prediction works. Some trade currencies while others prefer stocks. In order to satisfy various requirements coming from different traders, brokers offer dedicated account types.

Demo Account

Demo trading is essential for beginner traders to master their craft and get used to using trading software. Furthermore, demo trading is very useful for experienced traders in testing and developing their trading strategies. Demo accounts are very similar to live trading accounts. Instead of placing orders using real money, demo traders open and close positions using fake money.

While demo trading is great for practicing, it has some downsides. The biggest disadvantage of trading with a demo account is that traders are not as invested and interested when there’s no real money to be made. There’s almost no emotional connection. As a result, beginner traders often experience the importance of discipline when they go live.

FXTM clients can demo trade Forex and other asset classes, but unfortunately, demo trading for stocks is not optional.

Micro account

The minimum initial deposit required to open the Cent account is just $10. Unfortunately, the Cent account only offers access to MetaTrader 4. What’s more, spreads for this account are even higher than for the Standard one, starting from 1.5 pips. Leverage for Forex pairs is in a range of 25:1 to 1000:1. As for the metals, it’s 25:1 to 500:1.

Stop Out level for the Cent account is 40%. Meaning the broker will close your positions in order to prevent your funds from going negative every time the price reaches the 40% margin level. The margin call level is 60%.

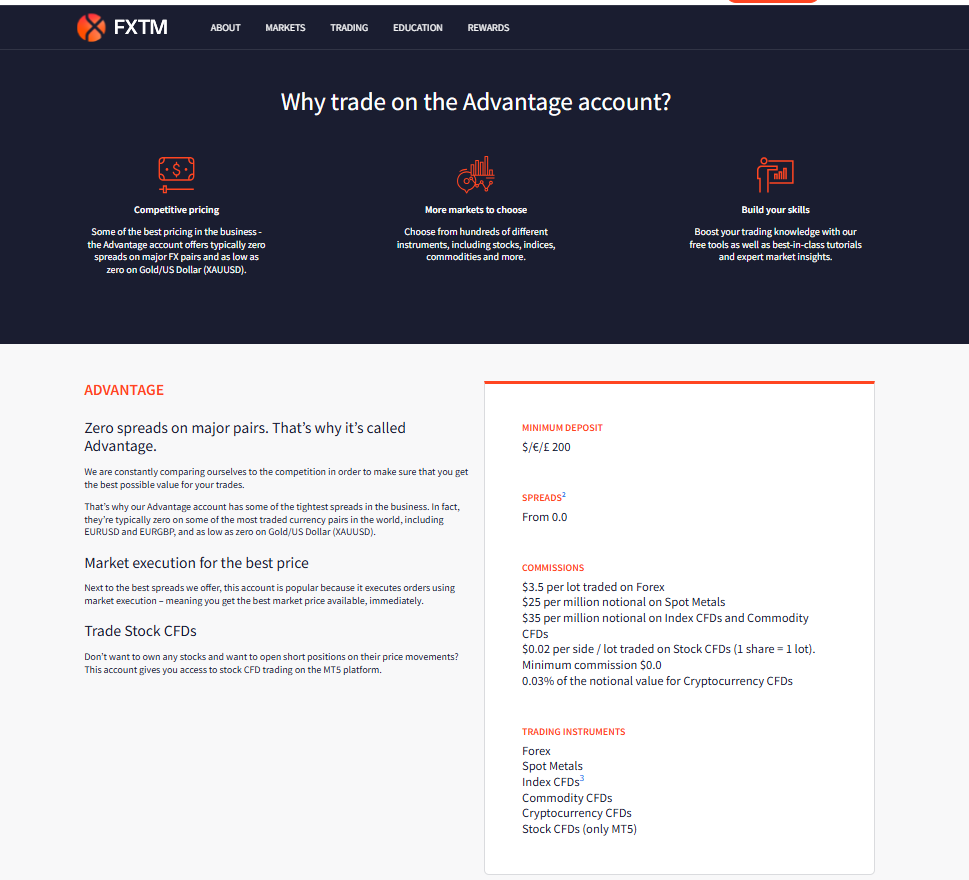

Advantage Account

The Advantage account doesn’t have spread markups from the broker, which means the prices are raw, coming straight from the liquidity providers. On the other hand, traders are charged with average commissions of 0.4 – 2 USD based on the volume traded. The account type is suitable for intraday and high-frequency traders as traders that are placing more orders than position traders prefer to pay for commissions and save on spreads.

The account offers 4 base currencies: USD, GBP, EUR, and NGN. It’s recommended to choose the currency type that you use the most on a daily basis to save on conversion. Keep in mind that the account requires a higher initial deposit of 500 USD, GBP, EUR, or 80,000 NGN depending on your account base currency type.

Advantage Plus Account

The Advantage Plus account has a lot of similarities with the Advantage account type. Both offer up to 2000:1 leverage, and both have the same initial deposit requirements and Stop Out levels. But they are very different from each other.

FXTM Advantage Plus charges 0 commission. On the downside, the spreads are starting from 1.5 pips. The 1.5 pip markup is very high compared to other Forex brokers. Keep in mind that in a live trading environment, spreads can get much higher due to a lack of liquidity. The account type is aimed at position traders that make fewer trades than intraday and high-frequency traders. Position traders don’t mind paying a little extra on opening positions when they know that there’s no commission per traded lot.

In addition, the account type doesn’t offer the Nigerian currency NGN as the account base currency.

Islamic account

FXTM offers swap-free accounts in compliance with Sharia law. The account type doesn’t charge interest to clients for keeping positions overnight. The broker doesn’t allow investors to keep positions open without any fees for too long though. In fact, if you have an Islamic account and your position is open longer than 7 consecutive days, a daily swap fee will be charged by the broker.

What’s more, keep in mind that not all of the trading instruments are available when using the swap-free account. For example, you won’t be able to trade exotic pairs using the account type.

Fees & Commissions

The fees charged by FXTM are high compared to other Forex brokers. Spreads start from 1.5 pips on a Standard account, which is a pretty big markup. Keep in mind that in live trading conditions, spreads can be even higher.

In addition to high spreads, the broker charges its client a withdrawal fee of $3 when using the credit/debit card option.

Trading Platforms

FXTM gives traders access to two of the most widely used trading software, MetaTrader 4 and MetaTrader 5. Both platforms are developed by MetaQuotes Software corp and have a lot of similarities.

Let’s talk about the differences to make choosing easier for you. MetaTrader 4 was released in 2005 and is mostly used for trading currency pairs. Metatrader 5 was released five years later. MT5 is often referred to as an all-in-one platform due to its ability to offer different asset classes for trading.

Mobile Trading

FXTM offers access to MT4 and MT5 mobile trading apps. You can download the software of your choice for your iPhone or Android devices. Mobile trading can be very beneficial for most traders due to the fact that it provides access to markets from anywhere in the world.

MT4 and MT5 provide interactive charts and a full set of trading orders while giving you the ability to monitor your account status 24/7.

Education and Research Tools

Education is vitally important in the world of trading. Beginner traders require well-put-together educational material to advance their knowledge and become profitable traders in the long run. FXTM offers superb educational content including a glossary, video guides, Forex trading guides for beginners, CFD trading guides for beginners, and more. The information is easily accessible from the broker’s main page under the knowledge section.

What’s more, FXTM offers an economic calendar and daily market analysis. Keep in mind that while still learning how to trade, it’s beneficial to see how various traders conduct market analysis. In addition, trusting trading signals blindly can damage your trading results. There are various trading styles, timeframes, and asset classes in the markets. Each trader needs to find what works best for him/her.

Customer Support

Great customer support is the heart and soul of every company. FXTM truly shines when it comes to creating a brilliant customer experience.There are a couple of live chat methods you can choose from. You can contact the customer support team via live chat, WhatsApp, Telegram, or Messenger. The customer support team is very responsive, professional, and friendly.

In addition to online chat, you can send the broker an email or call a local office. FXTM customer service offices are available 24/5 over the phone and are located in different parts of the globe. The call center offices are located in India, Kenya, Indonesia, Nigeria, and South Korea.