- Low fees for Forex and CFD trading

- High-quality educational content with webinars on YouTube

- MetaTrader platform suite available with streaming Forex news headlines

- Exchange-traded securities through the Henyep Securities platform

- No fees on deposits and withdrawals

- Fast and fully digital account opening process

- Licensed by 5 regulatory bodies

- The custom mobile app of HYCM does not support trading, it only serves as a client portal

- Charges account inactivity fee

Everyone can agree that the Forex trading market has grown massively over the past few years. Due to such massive growth, many new brokerages have been established. This makes it a bit hard for some traders to decide which one to use. Henyep Markets, better known as HYCM, has long been one of the leading Forex and CFD brokers. The brokerage was created several decades ago, back in 1977 in the United Kingdom. The broker is regulated and licensed by several agencies, including the UK Financial Services Commission, FCA, and the Cyprus Securities and Exchange Commission, CySEC. The Forex broker offers traders high-quality services and an array of trading assets to choose from.

HYCM is known for charging very low fees and offers traders rich educational material. With a user-friendly account opening procedure and user-oriented environment, HYCM is a broker to trust for many traders in the market.

HYCM Overview

| Regulations | Cayman Islands, Cyprus, UAE, UK |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 10 USD per month afther 90 days of inactivity |

| Minimum deposit | 100 USD. Minimum deposit for Fixed and Classic accounts – 100 USD. RAW account – 200 USD |

| Minimum account activation | 50 USD |

| Number of available assets | 301 |

| Leverage up to | 1:500. For UK and EU clients maximum leverage is 30:1 |

| Available trading markets | Commodities, Cryptocurrencies, Forex, Indices, Stocks |

| Account currencies | USD, EUR, GBP, RUB, AED, CAD |

| Demo account | Yes |

| Live account types | Fixed, Classic, Raw |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 71 |

| Shares | 0 |

| Cryptocurrencies | 29 |

| Indices | 28 |

| Commodities | 20 |

| Total | 301 |

| Fees & spread | |

| Forex | From 0.1 pips. Raw account EUR/USD fees start from 0.1 pips. Commission is $4 per round turn |

| Shares | N/A |

| Cryptocurrencies | From 0.00162 pips |

| Indices | From 0.02. 0.45 Target spread on US500. Raw account |

| Commodities | From 1.5 pips. In addition, $10 per round turn on Raw account |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Bitcoin, Credit/Debit Card, Perfect Money, Skrill |

| Minimum deposit | Bank Transfer, Bitcoin, Credit/Debit Card, Perfect Money, Skrill for Raw account, $250 with Bank Wire |

| Minimum withdrawal | Bank Transfer, Bitcoin, Credit/Debit Card, Perfect Money, Skrill. Most withdrawals take up to 1 hour. Bank Wire takes 1 to 5 working days |

| Withdrawal processing time | Up to 1 hour. Bank Wire proccessing can last 1 to 7 working days. Bitcoin transfer up to 3 hours |

| Time to open an account | – |

Safety & Security

Our HYCM review shows that the Forex broker is regulated by several jurisdictions around the world. With over 40 years of history, it has managed to enjoy a reputation as a safe and secure broker.

The safety and security of a broker are of the utmost importance. While there are many brokers available in the market, not all of them are capable of providing traders with high standards of security.

HYCM manages to create a safe environment for clients by following the regulatory guidelines of agencies that are very well-known around the world. Among the licenses that it holds are:

- Financial Conduct Authority of the UK, FCA;

- Cyprus Securities and Exchange Commission, CySEC;

- Cayman Islands Monetary Authority, CIMA;

- Dubai Financial Services Authority, DFSA;

- Registered in Saint Vincent and the Grenadines.

Policies

In order to ensure the highest safety of its clients, there are different policies that the broker has adopted. Among them, you can find negative balance protection, account segregation, and so on.

When you are trading on high leverage, you are able to lose more money than you have on your account. This can be quite dangerous for traders, especially for those who are just getting started. In order to avoid such scenarios, the broker has adopted a negative balance protection policy. This ensures that when you are trading on leverage, your positions are closed automatically whenever your account balance reaches zero.

The Forex broker also keeps the funds of clients in segregated bank accounts, which is a very important policy that guarantees the safety and security of Forex traders. No matter what goes wrong, even if the broker goes bankrupt, traders will still be able to have access to their funds, all thanks to account segregation. For this purpose, HYCM has partnered up with leading banks throughout the world, which ensures the safe storing of clients’ funds.

Apart from this, HYCM is also a member of the Investment Protection Fund, which ensures that in case of security issues, the traders will be compensated at least part of their account balance.

Trading Assets

When reviewing HYCM, we found that this Forex broker offers traders a wide range of trading assets. While the number of assets offered is lowish when compared to other leading Forex brokerages available in the market, there is still a good selection of trading instruments for the clients.

The most important thing making HYCM a good fit for traders of all different interests and wants is the fact that traders can easily find something that fits their individual needs. Below, we will go through the different types of instruments available.

Forex trading

Forex trading, for a long time, has been a leading financial market. There are millions of people trading currency pairs every single day, and because of this, it should not come as a surprise that the team behind HYCM is largely focused on providing its customers with high-quality Forex trading services.

One of the biggest advantages of trading currency pairs on HYCM is that there are over 70 currency pairs available. This includes all majors, most minors, and some exotics. The maximum leverage for Forex trading on HYCM is 1:500, however, depending on your location, there might be some limitations. For example, if you are a trader from the EU using HYCM, you won’t be able to use leverage higher than 1:30 due to local regulations. The spreads for currency trading are very low on HYCM and start from just 0.1 pips depending on the market conditions.

Stock trading

HYCM offers traders the opportunity to trade stocks using CFDs. These are very popular assets, which are used by traders who do not want to buy the stocks themselves, but rather speculate on their price changes. CFDs allow traders to use higher leverage.

The maximum leverage for stock trading on HYCM is 1:20 and the margins start from just 5 percent. If you do not want to trade CFDs and want to invest in stocks directly, you have the opportunity to do that with HYCM. The broker offers traders a special trading account that can be used to trade not only stocks but also exchange-traded funds, which have become very popular among traders over the past few years. There are dozens of ETFs available for the clients of HYCM.

Depending on what your interests are, there is a good array of choices of stocks on HYCM. However, it should be noted that there are many other Forex brokers available in the market that offers clients access to a larger variety of stocks for trading.

Indices trading

Indices are very popular among traders who want to invest in larger markets. This asset class allows individuals to have exposure to the whole market with only one investment.

Indices list different types of stocks in one asset, which allows traders to diversify their investment through an entire industry. The indices are made up of different stocks. For example, there are some indices that are made up of stocks representing certain countries, whereas there are other indices that are made up of stocks representing a certain part of the economy.

By trading indices on HYCM, traders have the opportunity to gain instant access to the global equity markets. There are over 15 leading indices available for the clients of HYCM, and the maximum leverage for index trading is as much as 1:200. However, keep in mind that there might be different limitations on the leverage you can use depending on local regulations in your country of residence.

Cryptocurrency trading

Over the past few years, cryptocurrencies have become one of the most popular assets around the world. There are many different ways you can trade cryptocurrencies today, but it has become very common for people to trade them as CFDs.

There are several reasons for this. First, using CFDs for crypto trading is a great way to make a profit from the market without having to worry about storing them in a crypto wallet. This happens because when you trade crypto CFDs, you are not dealing with the crypto assets directly. You are simply speculating on how the price of the underlying asset is going to change.

While there are not so many cryptocurrencies available on HYCM, the clients of the broker still have access to some of the best-known and most popular digital coins globally. Among the crypto assets that can be traded on HYCM are Bitcoin, Ethereum, Litecoin, and several others. The leverage for crypto trading goes up to 1:20.

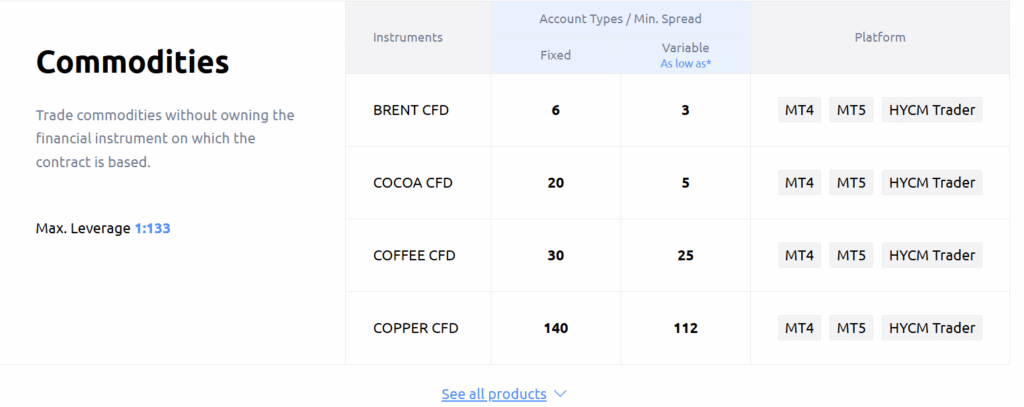

Commodities trading

While working on this HYCM review, we found that among many assets available on HYCM are commodities. These assets have been very popular among traders since the dawn of time. HYCM offers traders both soft and hard commodities.

Among the commodities that can be traded on HYCM, you will find Brent oil, cocoa, coffee, copper, and many others. The maximum leverage available for commodities trading on HYCM is 1:133.

Account Types

In order to help traders find something that fits their individual needs and interests, HYCM offers different types of accounts. Such a diverse offering can be quite important for Forex traders. This way, they will be able to trade according to their individual interests in the market.

Choosing which account type you want to use can be quite tricky, but as long as you are able to tell what you are looking forward to from the Forex trading market, it should not be hard to open an account and start trading with HYCM.

The best thing about an HYCM Forex trading account is that signing up for one of them is not hard and should not take more than a day for it to be ready for trading. Below, we will go through different types of accounts available on HYCM and see what they have to offer.

Demo Account

If you are new to the Forex trading market, you should definitely start out with the demo account of HYCM. When you first open a demo account, you will receive a certain amount of virtual cash from the Forex broker.

The main aim of this account is to let traders try out different types of trading styles and strategies and determine how they work in different market conditions. This account can also be used by beginners to get used to the way Forex trading works and really learn how to use the trading platform and tools that come with it.

A very important thing about the demo account is to remember that even if you have some experience in the market, this account can still be used to test trading strategies and back-test trading ideas.

Fixed Account

Once you are done with the demo account, you can choose from the three available live trading accounts that are offered by HYCM. The first one is the Fixed account. The name of this account is derived from the fact that those who open this account will have to pay fixed spreads of 1.5 pips.

There is no commission on deposits or withdrawals for holders of this account, and traders are also not required to pay additional fees on trades. The minimum deposit to open a Fixed account is just $100. While Fixed account holders can access almost all the services available on HYCM, they can’t use Expert Advisors (EAs). EAs can be very useful for traders to automate different parts of the trading process. If you are planning on using EAs for trading, the Fixed account is not the right choice for you.

Classic Account

The second type of account that can be used by the clients of HYCM is the Classic account. This account can be a great choice for traders who are looking for a regular Forex trading experience. Let’s say that you are a trader who simply wants to go on the Forex broker’s platform, open and close positions, and be able to receive standard services. If so, then the Classic account of HYCM is a perfect choice for you. The holders of this account will have to pay variable spreads for trading, and they start at 1.2 pips.

There is no additional commission to be paid by Classic account holders. To open this account, you will be required to deposit at least $100. Those using the fixed account are also able to use EAs for trading.

Raw Account

The third type of account that the clients of HYCM can create is called a Raw account. The name of this account is derived from the type of spreads charged, namely raw spreads. The spreads for the Raw account are very competitive and low, starting at just 0.1 pips.

However, it should be noted that the holders of this account will be required to pay $4 per round. An additional fee like this is only charged to the holders of the Raw account. Another difference between the raw account and others is the fact that the minimum deposit for it is $200.

Islamic Account

HYCM is one of the Forex brokers that really aims at being a global player, offering services that can fit the interests of traders of all backgrounds. Because of this, it should not come as a surprise that HYCM offers traders an Islamic account.

This account is specifically created and tailored to make sure that it does not go against the beliefs of the Quran. To avoid this, the HYCM’s Islamic account does not charge or give out any types of swaps. For this reason, Islamic accounts are also known as swap-free accounts.

Fees & Commissions

The fees and commissions charged by HYCM are very competitive when compared to other Forex brokers available in the market. There are different fees charged for different assets, and the fees that you might have to pay also depend on the account type you have created.

A very important advantage of HYCM is that it does not charge any fees or commissions for deposits. While there are no fees charged for deposits, there are some fees charged for withdrawals. For example, there is a $30 fee for wire transfers under $300. As for other payment solutions, such as Skrill and Neteller, there is a 1 percent fee for withdrawal. The rest of the payment solutions have no fees charged for them.

There is an inactivity fee charged by HYCM. While there are many Forex brokers that charge inactivity fees, many more brokers are getting rid of this fee. On HYCM, accounts that remain inactive for over 90 consecutive days, will be charged an administration-inactivity fee of $10. This fee will be charged every month for as long as the account remains inactive. Because of this, it is very important to contact customer support representatives if you decide to quit trading at any point. This way, you will be able to deactivate your account and ensure that you are not getting charged by the broker.

Trading Platforms

When reviewing HYCM, we were very glad to find out that this Forex broker offers traders some of the leading trading platforms available in the market. This ensures that traders are able to access the highest quality of services at all times. Among the trading platforms that are available on HYCM are MetaTrader 4 and MetaTrader 5.

Both of these trading platforms were created by the same company called MetaQuotes. MT4 was released in 2005, and it has forever changed the way people view the Forex trading market. As for the MT5, it was released in 2010 and offers a wider variety of assets.

MetaTrader 4 is a platform that is heavily focused on Forex trading, while MT5 offers traders access to other assets as well, which makes it a great option for traders of all different interests.

Both MT4 and MT5 can be great options for traders to do extensive market research and technical analysis. These platforms come with numerous technical indicators which can be used to analyze the price movements in the market in greater detail.

Apart from this, these platforms also come with special bots called Expert Advisors, which can be used to automate some processes of the Forex trading market.

Mobile Experience

While HYCM is a very old Forex broker, being established over 40 years ago, it has managed to stay up to date with the ongoing developments and trends in the Forex trading market. Among many things that this Forex broker has done is that it offers traders mobile trading services.

By taking advantage of the MetaTrader 4 and MetaTrader 5 mobile apps, users of both Android and iOS devices can easily trade Forex using their smartphones. This is a very important thing for many traders today, as it allows them to enjoy the Forex trading market at any time during the day and wherever they might be.

Education & Research

The importance of financial education and a good understanding of the Forex trading market can’t be stressed enough. There are many things that traders have to know about Forex trading before they get started, and a very huge advantage of HYCM is that it offers clients numerous opportunities to learn more and grow as traders.

Apart from regular webinars and educational guides, HYCM offers different types of videos through its YouTube channel. Here, with the help and support of some of the most experienced Forex traders in the market, HYCM is helping its clients to find ways to better understand different types of confusing and hard topics about Forex trading. They also offer clients different types of educational and research tools that can be used for better market analysis and understanding of the possible price movements in the near future.

Customer Support

There are many different options that the clients of HYCM have to contact customer support representatives. This team of professional agents is able to provide traders with information in several different languages, which means that the clients of HYCM are able to receive much-needed information in the most useful manner. You can contact the customer support team either from the live chat, the hotline, or email, as well as using the help center to find information on your own.