- Charges inactivity fee

- Limited product portfolio when compared to industry leaders

- Platforms do not offer safer, two-step login

Established in 2009, XM has evolved into one of the world’s most prominent online Forex brokers, serving over 5 million clients across more than 190 countries. Its global presence and reputation make it one of the most trusted names in the trading industry today.

XM provides access to a diverse range of trading instruments, including Forex, CFDs on stocks, indices, commodities, and more. Over the years, the broker has earned licenses from top-tier regulatory authorities such as the UK’s FCA, Cyprus’ CySEC, and Australia’s ASIC, among others—further reinforcing its credibility.

One of XM’s key strengths lies in its competitive pricing, offering tight spreads starting from just 0.6 pips on major currency pairs. In this review, we’ll explore the key features that have helped XM maintain its status as a leader in the Forex space. Let’s dive into what XM has in store for traders.

XM Overview

| Main features | |

| Regulations | Cyprus, Australia, UAE, UK, Belize |

| Fees on deposits | $0 |

| Fees on withdrawal | $0 |

| Inactivity fees | $15. $5 per month after 90 days of inactivity |

| Minimum deposit | $5. Minimum initial deposit for Shares Account is 10,000 USD |

| Minimum account activation | $5. Once an account is archived, it cannot be reactivated |

| Number of available assets | 1200+ |

| Leverage up to | 1:1000. There’s no leverage available for Shares account |

| Available trading markets | CFDs on Stocks, Commodities, Cryptocurrencies, Forex, Indices, Stocks |

| Account currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, RUB, SGD, ZAR |

| Demo account | Yes |

| Live account types | Micro, Standard, XM Ultra Low, Shares Account |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 57 |

| Shares | 100 |

| Cryptocurrencies | 31 |

| Indices | 14 |

| Commodities | 8 |

| Total | 1200+ |

| Fees & spread | |

| Forex | From 0.6. For Micro and Standard accounts, spreads start from 1 pip |

| Shares | From 0. As per the underlying exchange |

| Cryptocurrencies | From 0.0017. Spreads on BTC/USD start from 39 |

| Indices | From 0.00010 |

| Commodities | From 0.3 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Credit/Debit Card, Neteller, Skrill, UnionPay, WebMoney, XM Card, M-Pesa |

| Minimum deposit | Bank Transfer, Credit/Debit Card, Neteller, Skrill, UnionPay, WebMoney, XM Card, M-Pesa |

| Minimum withdrawal | Bank Transfer, Credit/Debit Card, Neteller, Skrill, UnionPay, WebMoney, XM Card, M-Pesa |

| Withdrawal processing time | Instant |

The Safety & Security

When selecting a Forex broker, one of the most crucial factors to consider is the safety and security they provide. A broker’s regulatory status plays a major role in determining how reliable and trustworthy their operations are.

In the case of XM, our review found that the broker is authorized and regulated across five prominent jurisdictions, reinforcing its credibility and global reach. The licenses held by XM include:

Cyprus Securities and Exchange Commission (CySEC)

Australian Securities and Investments Commission (ASIC)

Dubai Financial Services Authority (DFSA)

Financial Conduct Authority (FCA), United Kingdom

International Financial Services Commission (IFSC), Belize

These licenses empower XM to serve clients across a wide range of regions. For example, its CySEC license grants access to the entire European market, while the IFSC license from Belize enables the broker to extend its services globally, covering multiple international jurisdictions.

Overall, XM’s strong regulatory framework is a key reason why it is considered a secure and reputable choice for online trading.

Available Assets XM – What Can You Trade?

XM offers traders access to over 1,200 trading instruments, spanning various asset classes. While this number may be lower compared to some top-tier brokers, it still provides a diverse enough selection to cater to most trading strategies and preferences.

All account types on XM allow access to these instruments, ensuring flexibility for traders regardless of their experience level. However, it’s important to note that real shares are only available through the dedicated Shares Account. For those interested in CFDs on shares, these can be traded through the other standard account types as well.

Forex

XM offers clients access to all types of Forex currency pairs, including major, minor, and exotic currency pairs. There is a total of over 55 currency pairs available for trading on XM. The XM leverage for FX trading is up to 1:1000, however, keep in mind that there might be some restrictions on the maximum leverage based on your location. For example, for traders from the EU, the maximum leverage is 1:30 due to the local regulations in this region. Similar laws are in place in Australia and several other jurisdictions around the world.

Shares

When it comes to trading markets, investing in stocks is the way to go for many people. Thus, it is quite important for brokers to ensure they offer these assets to their clients. There are two ways for individuals to trade shares on XM.

The first option is very common for brokers in the market today, namely, trading stocks as CFDs. This method includes traders making certain predictions about the possible direction prices could take and then opening contracts according to their predictions.

Indices

On XM, traders can have access to numerous indices. The total number of indices available on XM is 14. This includes the largest and best-known indices around the world, representing industries of countries like the US.

Indices offered by XM give you the opportunity to have cost-effective and direct access to global markets.

Commodities

There are 8 different commodities available on XM. This includes soft and hard commodities such as cocoa, coffee, copper, and many others. Trading commodities can be done using CFDs.

This means that rather than buying the commodities directly, the clients of XM simply speculate on the possible price movements of these assets. Commodities can play a huge role when it comes to portfolio diversification.

Cryptocurrencies

Digital currencies are some of the most popular assets today. On XM, they can be traded as CFDs. There are five crypto assets available for clients of XM. For these XM allows traders to use leverage of up to 1:250, which is quite high.

The crypto market can be accessed 24 hours a day, 7 days a week. Among the crypto assets that can be traded on XM are BTC, BCH, ETH, LTC, and XRP. Digital assets can be great for investors to diversify their portfolios.

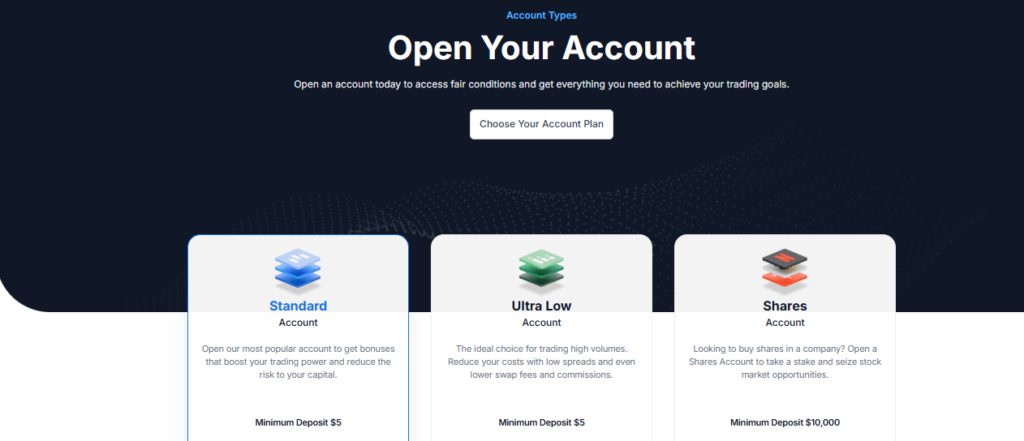

Account Types

To cater to the diverse needs of traders, XM has designed a range of account types, each tailored to suit different trading styles and experience levels. This flexibility allows traders to choose an account that aligns perfectly with their goals and strategies.

Let’s take a closer look at the various account types offered by XM, and explore what makes each one unique.

Demo account of XM

Every client of XM is entitled to have a demo account. This type of account is very popular in the Forex trading market and is widely used by both beginner and experienced traders.

Beginner traders can use a demo account as a way to learn more about the Forex trading market. Experienced traders can find a demo account useful for testing out new trading styles and finding out what works best for them.

When creating a demo account, the broker will provide you with a certain amount of virtual cash, which can be used for trading. You can use this virtual cash for as long as you want to and if you run out of virtual money, you can always contact the customer support of XM and ask them to provide more.

Standard account

The Standard account offered by XM can be a perfect match for traders of all different interests. To put it simply, this account was created with different types of traders in mind. Whether you are looking for ways to start trading with huge amounts of money, or you want to find a way to limit your losses, the standard account can be a great fit.

In general, the standard account was created with intermediate-level traders in mind. Those using this account will deal with standard lots, which equal 100,000 units of the assets being traded. The leverage is the same as it was for the micro account and can go up to 1:888, depending on the size of your positions.

However, traders should also keep in mind that if they are from Europe, the available leverage will be limited to 1:30. The same regulation also applies to traders from Australia and several other parts of the world due to local regulatory standards. The minimum amount of money that you have to deposit to open the live account is $5. This is the case for the Micro account as well.

The Standard account is pretty much a great choice for traders of all interests. It offers you access to almost everything that other account types do, except the fact that you can’t trade real stocks with this account, rather, you will have access to CFDs.

Ultra-low account

This XM account type is a great option for traders who wish to limit the costs of Forex trading. Unlike other accounts, where the base currency options are 9, for the holders of XMs Ultra-low accounts, there are only six base currency options.

They are, USD, EUR, GBP, AUD, ZAR, and SGD. As for the contract sizes, there are two options available for traders. First, it is the standard ultra, for which, 1 lot equals 100,000 units of the asset traded.

As for the micro ultra, the lot equals 1,000 units of the asset traded. The leverage is pretty much the same, depending on the location as well as the amount traded. Spreads are very low with this account, which makes it truly special.

For the major pairs, the spread can get as low as 0.6 pips. This account is basically a combination of the Standard and Micro accounts, offering traders the best of both worlds.

Shares account

If you are a trader looking for the opportunity to directly invest in stocks, there is a great offer waiting for you at XM. For stock investors, XM has created a special account type called a Shares account.

This account offers you the opportunity to directly invest in some of the leading stocks around the world. However, there are some conditions that should be kept in mind by traders. First, there is only one base currency option for this type of account – USD. The contract size is 1 share, and there is no leverage available for share account holders.

The spreads are greatly variable and depend on the underlying exchange. In addition to this, in order to create this account, you will be required to deposit at least $10,000. This is unlike any other account type offered by the broker, where the minimum deposit to open the account is just $5.

Islamic account

When working on the XM rating, we kept in mind that this broker also offers clients an Islamic account option. This account type is designed and created specifically for those who follow the beliefs of Islam. Every type of account is available in the Islamic version.

This account is a perfect fit for those who follow strict sharia law and they pay a fixed fee instead of swaps. This type of fee is not an interest payment and fully depends on the direction of your order. Because of the way it works, it is also sometimes referred to as a swap-free account.

Fees & Commissions

XM offers a competitive fee structure that aligns well with industry standards. While Forex spreads may be slightly higher than some other brokers in specific cases, the overall cost of trading remains reasonable and transparent.

The fees you incur largely depend on the type of account you choose and the assets you trade. Whether you’re trading Forex, CFDs, or other instruments, XM keeps its pricing fair and within expected market ranges, making it a cost-effective choice for both beginner and experienced traders.

Inactivity fee

Like many Forex brokers, XM applies an inactivity fee to accounts that remain dormant for an extended period. If no trading activity is recorded on your account for 12 consecutive months, a $15 inactivity fee will be charged.

After the initial fee, an additional $5 will be deducted each month until activity resumes or the account balance is depleted. If you decide to stop trading, it’s advisable to contact XM’s customer support to request account deactivation and avoid any unnecessary charges.

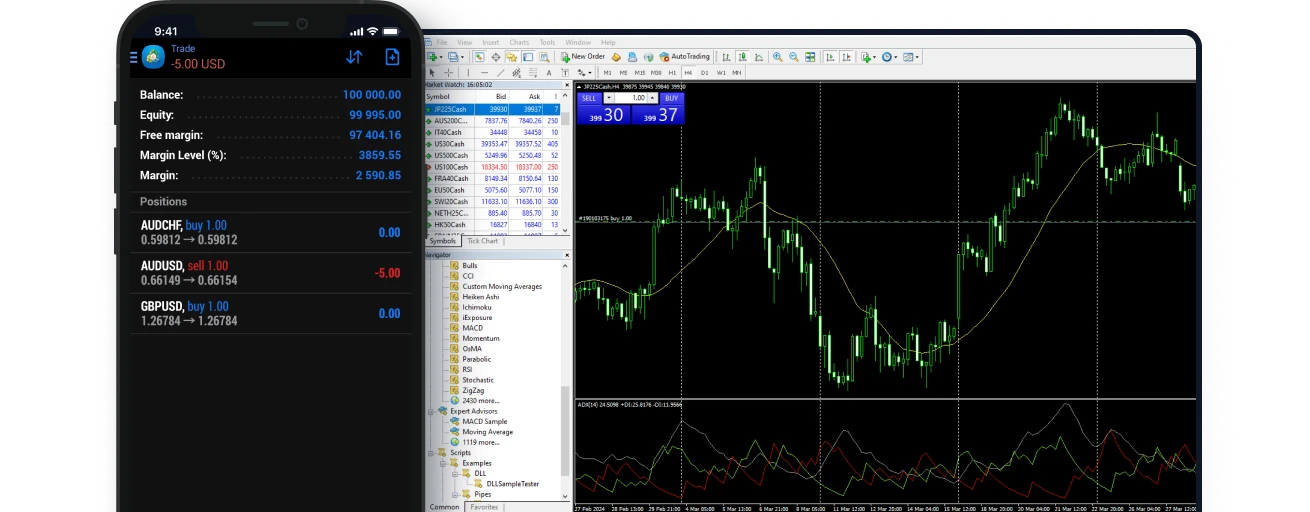

Trading Platforms

While working on this XM review, we evaluated several key aspects — and one of the most important for traders is the range of trading platforms offered.

XM excels in this area by providing a versatile selection. Traders can choose from the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, or opt for XM’s own custom-built trading app tailored for both mobile and desktop use.

Additionally, XM offers a web-based platform for those who prefer not to install software. This option is especially convenient for traders who value accessibility and flexibility without compromising on functionality.

Mobile Experience

XM also provides a mobile trading app, compatible with both MetaTrader platforms and its own proprietary platform. This ensures a seamless trading experience on the go, allowing you to monitor the markets, manage trades, and stay connected—anytime, anywhere. The mobile app is designed for ease of use without sacrificing the powerful features traders rely on.

Education & Research

XM stands out for its robust educational resources, designed to support traders at every level. From beginner-friendly Forex guides to in-depth video tutorials and structured educational courses, the platform equips new traders with the knowledge needed to navigate the markets confidently.

In addition to education, XM offers a comprehensive suite of research tools, helping traders analyze price movements more effectively. Daily market analysis, news updates, and expert insights ensure you stay informed about key market developments and trading opportunities.

Customer Support

One of XM’s key strengths is its dedicated and professional customer support team. The support staff is well-trained and highly responsive, ensuring traders receive accurate and timely assistance whenever needed.

XM offers multiple channels for customer support:

-

Live Chat: Instantly connect with a support agent through the broker’s website.

-

Email Support: Send detailed inquiries and receive informed responses from the team.

-

Phone Support: Speak directly with a representative via the customer service hotline.

This multi-channel approach ensures that help is always accessible, no matter where you are or what issue you’re facing.