- Regulated by four different regulatory bodies

- It only takes $25 to open and activate the trading account

- Experienced broker, established in 2001

- Deposits are instant and methods are many

- easyMarkets is partnered with Real Madrid

- Withdrawal details can only be seen after the account is opened

- Processing of withdrawals takes 1-2 business days

Established in 2001, easyMarkets is no newcomer to the Forex brokers scene. Regulated by multiple regulatory bodies and offering trading services on modern trading and charting platforms, the broker seems determined to stay stable for years to come.

We’ve reviewed easyMarkets in detail and will discuss our findings on its safety features, policies, trading fees, trading software, customer service, and more. Furthermore, in case you decide to open an account with this broker, we also provide a detailed description of how to open an account and get started.

easyMarkets Overview

| Regulations | Australia, BVI, Cyprus, Seychelles |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 0 USD |

| Minimum deposit | 25 USD |

| Minimum account activation | 25 USD |

| Number of available assets | 193 |

| Leverage up to | 1:500 |

| Available trading markets | CFDs on Stocks, Commodities, Cryptocurrencies, Forex, Indices |

| Account currencies | EUR, USD, AUD, NOK, CAD, SGD, PLN, SEK, CZK, CHF, TRY, ZAR, JPY, GBP, CNY, BTC, NZD, MXN, HKD |

| Demo account | Yes |

| Live account types | VIP, Premium, Standard |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 63 |

| Shares | 0 |

| Cryptocurrencies | 20 |

| Indices | 15 |

| Commodities | 31 |

| Total | 193 |

| Fees & spread | |

| Forex | From 0.3 pips |

| Shares | From 0 |

| Cryptocurrencies | From 0.0003 |

| Indices | From 0.55 |

| Commodities | From 1 pip |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5, TradingView |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | AstroPay, Bank Transfer, Credit/Debit Card, Fasapay, Neteller, Perfect Money, Skrill, WebMoney |

| Minimum deposit | AstroPay, Bank Transfer, Credit/Debit Card, Fasapay, Neteller, Perfect Money, Skrill, WebMoney |

| Minimum withdrawal | AstroPay, Bank Transfer, Credit/Debit Card, Fasapay, Neteller, Perfect Money, Skrill, WebMoney |

| Withdrawal processing time | instant |

| Time to open an account | – |

safety & security

Safety starts with proper licensing, and when evaluating a broker this becomes one of the most important things to look at. Since more regulators mean more oversight and tighter controls, the more regulators are regulating the broker, the better for traders.

easyMarkets is regulated by four independent authorities:

- Cyprus Securities & Exchange Commission “CySEC” (Cyprus) – license 079/07

- Australia Securities and Investments Commission “ASIC” (Australia) – license 246566

- Financial Services Authority of Seychelles “FSA” (Seychelles) – license SD056

- Financial Services Commission “FSC” (British Virgin Islands) – license number SIBA/L/20/1135

After seeing how many authorities there are overseeing this broker it is easy to deduce that easyMarkets is not a fly-by-night affair.

Policies

Policies define how the broker serves its customers and what it focuses on. easyMarkets is part of the Compensation Fund, meaning that there is some insurance protecting traders. Additionally, they save all clients’ funds on segregated accounts, which is critical as it limits the broker’s access to client funds and guarantees that even if the company goes out of business, traders get their funds back.

There is another crucial thing to look for when selecting a broker and that is negative balance protection. Because leveraged trading is a risky business that can amplify profits and losses hundreds of times, traders face the possibility of losing more money than they had in their accounts to start with. In order to protect traders from this, negative balance protection is employed, and easyMarkets has this in place.

Trading assets

The number of trading instruments offered by easyMarkets is moderate. Despite this, there are still various instruments available for trading spanning different asset classes. Forex, cryptos, and share CFDs are all present and will enable traders to find something worthwhile. There are 63 Forex pairs, which is a good amount when looking at currency trading platforms. From the table above, it is clear that the broker mainly focuses on Forex and despite having some CFDs available, they are limited.

Forex trading

Forex is one of the biggest international financial markets and there are trillions of dollars traded daily. easyMarkets has 63 currency pairs available, and although some other brokers have more pairs for trading, this is not a small number when it comes to currency pairs. It includes many minor and exotic pairs along with all the majors. The leverage offered on FX trading is 1:500 and as a micro account is available with easyMarkets, it will enable traders to easily trade any of these currencies with a small amount of starting capital.

Share CFDs trading

There are 64 shares as CFDs available on the easyMarkets platforms. Contracts for difference or CFDs offer unique speculative abilities to traders by allowing them to short-sell any share and make a profit even if the market is in a downtrend. There are shares as CFDs from major exchanges such as the USA and Europe, and easyMarkets offer their clients negative balance protection when trading CFDs together with competitive spreads and fast execution, making them really attractive for experienced traders.

Cryptocurrency trading

Although there are only 20 cryptocurrencies available, this is actually a decent amount for this kind of broker. Other popular cryptos offered by the broker include

- Ethereum

- Litecoin

- Ripple

- Litecoin

- Stellar

- Bitcoin Cash

No slippage, tight fixed spreads, advanced stop-loss technology, and instant execution are advantages when trading cryptos on easyMarkets platforms.

Indices

Indices are great to measure the overall market’s direction and can also be a nice instrument for trading. There are 15 indices offered by easyMarkets, with the lowest spread starting from 0.005 for USX/USD. Traders can trade EU, UK, US, AU, and Asian Indices and can use the deal cancellation feature to limit losses. Below, is the list of indices offered by the broker

- US 500SPI

- US 30DOW

- US TechNDQ

- UK 100FTS

- Germany 40DAX

- EU Stocks 50ESX

- Swiss 20SWI

- AustraliaASX

- Japan 225NKI

- Hong Kong 50HSX

- China 50CNX

- India 50IND

- USD IndexUSX

- France40cCAC

- Italy40cMIB

Fixed spreads with deal canceling abilities can assist traders to limit losses and increases profitability.

Commodities trading

Copper, crude, natural gas, and agricultural commodities together with metals are among the commodities offered by easyMarkets. Gold and other precious metals along with things like coffee, and other commodities are great instruments for trading in when looking for safe-haven assets during an economic crisis and as a way of hedging your capital against inflation. easyMarkets offers 31 different commodities to their clients. Noteworthy features of easyMarkets commodity trading are deal cancellation, award-winning support, and instant execution. Spreads are very competitive for commodities and start from 1 pip, making it cheap to trade favorite commodities.

Account types

Every trader needs a different type of account according to their trading style, capital, and other requirements.

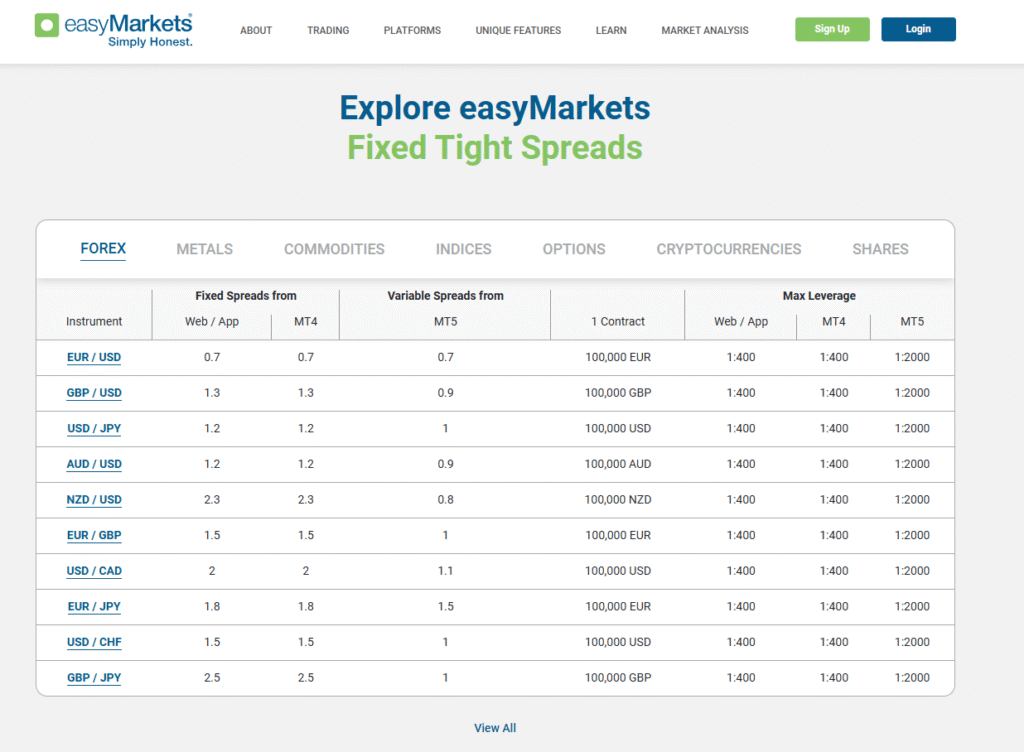

The account types offered at easyMarkets are VIP, Premium, and Standard. The different types of accounts have different terms and spreads, with a different minimum deposit size required for each account as well. The minimum deposit for a VIP account is $10,000, for Premium accounts, it drops to $2,000, and just $25 is needed to open a Standard account. All the spreads are fixed except for MetaTrader 5, where spreads are dynamic. The VIP account offers the lowest spreads for all trading platforms, from 0.3 pips for MetaTrader 5 (MT5), and it seems like the best option for low spreads is to use MT5 when trading. The leverage is also highest for MT5 with the 1:500 option. Another difference between account types is that live support is not available for easyMarkets web traders and TradingView platforms, and is only for VIPs. For TM4 and MT5 accounts, all support is accessible without interruption. .

Demo account

When starting to learn how to trade or when developing a new trading strategy, it is essential to be able to trade as if you are trading in a real market. A demo account does exactly that and offers virtual funds to trade with on a simulation of the real markets. Everything is real, except there is no actual money involved. This does a few things; enables beginners to learn trading skills without losing money, offers the ability to check how well the strategy behaves in real markets and offers a glance at the fees and spreads of the broker.

EasyMarkets has a Demo account, and its registration is similar to that of a live account. Only a few things are required, like email and phone number, and you are free to start testing any trading in a simulated real-time market environment.

VIP Account

VIP accounts can be opened with a minimum deposit of $10,000 and offer the best overall terms for traders. Spreads are minimum and start from 0.7 pips for MetaTrader 4 (MT4) and from 0.8 pips for the web trader and TradingView, the spread is lowest for MT5 starting from 0.3 pips. So, in order to receive maximum value, it is better to trade on the MT5 platform. Since TradingView is popular among many traders, it is possible to analyze charts on TradingView and then open an actual trade on the MT5 platform for lower spreads. If the strategy that you want to use is a scalping one, this becomes a bit challenging, but still possible with the right approach. Trading oil-related pairs is the cheapest on easyMarkets’ VIP accounts, with spreads starting from 0.04 USD. Maximum leverage accessible is 1:200 for MT4 and TradingView, 1:400 for MT4 platforms, and 1:500 for MT5 platforms.

Premium Account

Following the VIP account, the Premium account requires a minimum deposit of $2,000 to get started. It offers medium spreads, fees, and overall features. Minimum spreads start from 1.5 on web trader and TradingView and 1.2 for MT4, it is dynamic and starts from 0.3 pips on MT5.

Standard Account

The Standard account is the cheapest to start trading as it requires only $25 to open an account. There are no commissions related to account opening, activating, or depositing, making it easier for beginners to start learning trading skills. The spreads are high though with 1.8 and 1.7 pips for easyMarkets web trader, TradingView, and MT4. These spreads are fixed and offer stability during trading. For MT5, the spreads start from 0.3 pips and are dynamic. This could be misleading as it is not clearly indicated if the minimum spread on MT5 includes all three accounts or only VIPs. When starting with low capital, MT5 seems a bit better on easyMarkets as it is offering the lowest spreads and highest leverage of 1:500. The leverage for the web trader and TradingView for Standard accounts is 1:200 and for MT4 it’s 1:400, wish is similar to the other account types.

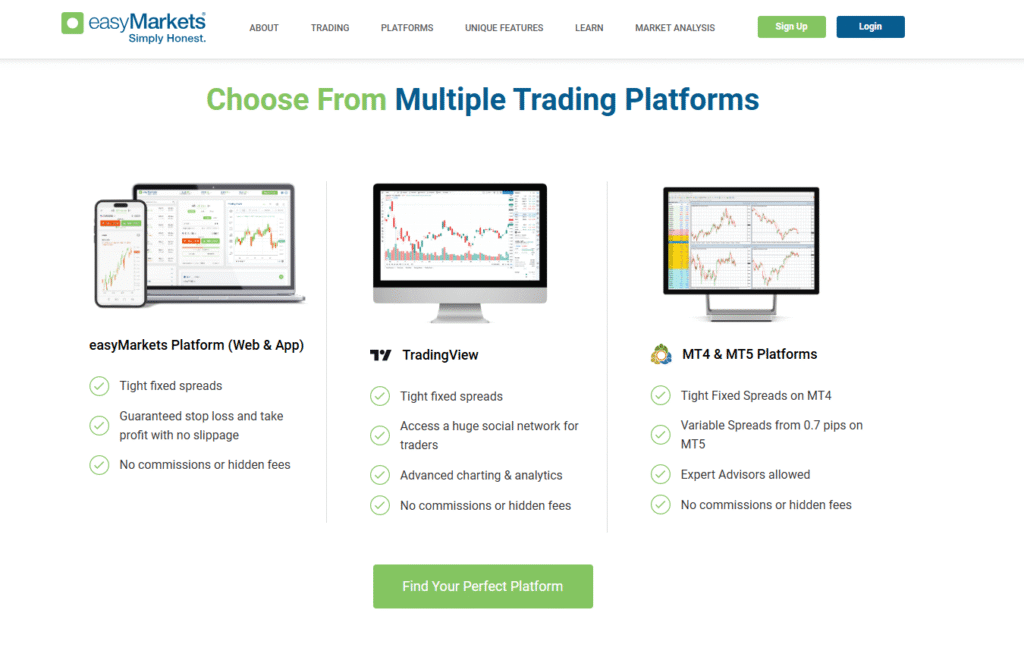

Trading platforms

The trading platforms available on easyMarkets are TradingView, MetaTrader 4, and MetaTrader 5, with MetaTrader 5 offering the overall best experience for Standard accounts.TradingView is an advanced charting and trading platform offering built-in and community-built custom indicators to all users on all devices. The desktop version is the most feature-rich, but you can access all custom indicators on mobile devices too, which is its greatest advantage. It offers live trading by connecting your broker to your charts to trade directly with TradingView. This feature is limited on mobile devices as of now.

The broker provides traders with the full set of MetaTrader platforms. These are among the oldest and most popular trading platforms on the market today and are a go-to for many amateurs and professionals. They offer a lot of features, including custom indicators and trading robots called Expert Advisors or EAs. The functions on mobile MT4 and MT5 apps are extremely limited though, making it impossible to use custom indicators. There is no dark mode or feature to get rid of the grid on the charts. When trading from mobile devices it is best to use easyMarkets’ own software as it is very intuitive and easy to use. There are many useful functions available with all assets being classified and sorted, and gives the feeling that they spent some time creating a well-thought-out and implemented solution.

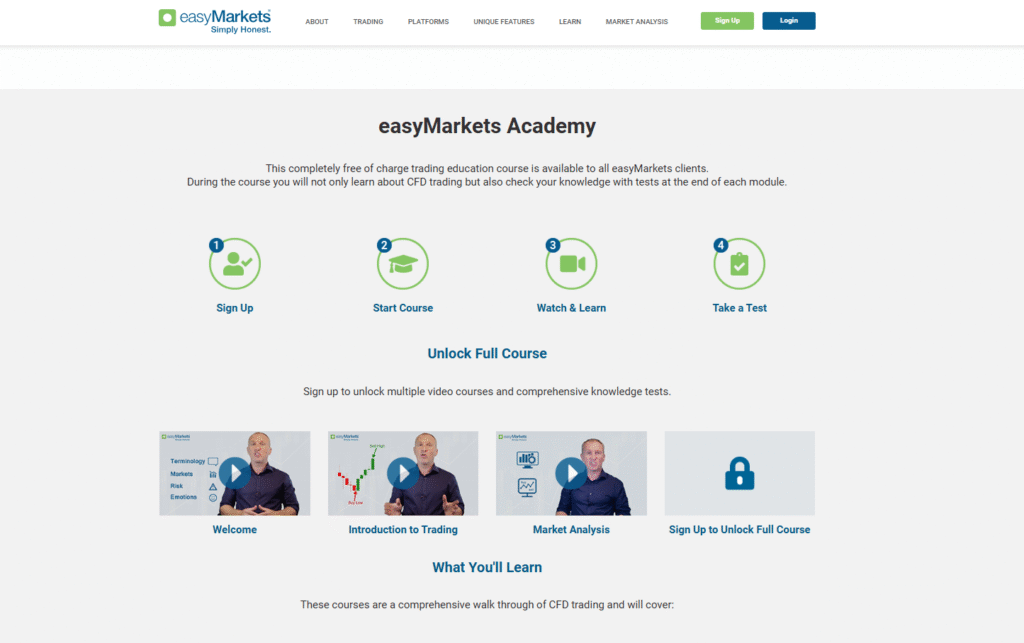

Education and research tools

Education is key when it comes to trading successfully. easyMarkets offers a whole section dedicated to everything Forex education related.

Customer support

Customer support is excellent at easyMarkets and they were very responsive in answering any questions and providing all the necessary information while researching the broker, providing everything in under a minute. Live chat is available 24/5, and we found the support team to be very responsive, polite, and knowledgeable providing assistance for all questions and issues.

If you want to get in touch with easyMarkets in other ways, they offer various support alternatives including live chat, messaging, a phone number, Facebook, and WhatsApp; giving traders ample options when it comes to communication.