- Regulated in 4 jurisdictions

- Offers access to MetaTrader 4, Next Generation CFD, Share trading standard platform, and Share trading Pro platform

- Charges no deposit and withdrawal fees

- Offers access to over 45,529 trading assets. Including more than 35,000 physical shares.

- Reasonable fees

- Fast and digital account opening/verification

- Offers a huge variety of Forex pairs

- Charges 10 EUR or equivalent inactivity fee after 12 months of inactivity.

CMC Markets is one of the oldest and most experienced brokers still operating today. The company was founded in 1989 and managed to grow its business rapidly. CMC markets have won 50 industry awards from 2020 to 2022 and are continually innovating.CMC Markets is one of the few brokers that offer both physical shares and shares as CFDs. In addition, you can trade an outstanding variety of Forex pairs, indices, commodities, and bonds.

The broker is authorized and regulated by top-tier financial institutions, including the Financial Conduct Authority of the UK (FCA), the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) of Germany, the Monetary Authority of Singapore (MAS), Australian Securities and Investment Commission (ASIC), and the Investment Industry Regulatory Organization of Canada (IIROC).

CMC Markets Overview

| Regulations | Singapore, Germany, UK, Canada, Australia |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 10 EUR or equivalent inactivity fee after 12 months of inactivity. |

| Minimum deposit | 0 USD |

| Minimum account activation | 0 USD |

| Number of available assets | 45,529 |

| Leverage up to | 1:500 |

| Available trading markets | Forex, CFDs on Stocks, Stocks, Indices, Commodities, Cryptocurrencies, Bonds |

| Account currencies | 10 |

| Demo account | Yes |

| Live account types | 3 |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 330 |

| Shares | 35000 |

| Cryptocurrencies | 19 |

| Indices | 80 |

| Commodities | 100 |

| Total | 45,529 |

| Fees & spread | |

| Forex | From 0.7 pips |

| Shares | From 0.5 |

| Cryptocurrencies | From 0.5 points |

| Indices | From 0.5 |

| Commodities | From 0.5 |

| Software | |

| Platforms | MetaTrader 4, Next Generation CFD |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Credit/Debit Card, Bank Transfer, PayPal |

| Minimum deposit | Credit/Debit Card, Bank Transfer, PayPal |

| Minimum withdrawal | Credit/Debit Card, Bank Transfer, PayPal |

| Withdrawal processing time | Instant. Some deposit options might take longer and some withdrawals can take up to 5 working days |

| Time to open an account | 1 |

The safety & security

In the world of finance the most important word is trust. Traders need to make sure that their broker is well-regulated before transferring funds to them.

CMC Markets consists of representative companies regulated by various brokers. Depending on where you are located, your broker might have a different regulator. For example, CMC Markets UK plc and CMC Spreadbet plc are supervised by the Financial Conduct Authority (FCA).

- CMC Markets Germany GmbH is regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin).

- CMC Markets Canada Inc. is a member of the Investment Industry Regulatory Organization of Canada (IIROC)

- CMC Markets Singapore Pte. Ltd. is regulated by (MAS).

- CMC Markets Asia Pacific Pty Ltd is registered with the Australian Securities and Investments Commission (ASIC).

The number of high-trust regulatory bodies that have authorized CMC Markets indicates that the broker is trustworthy.

Policies

In accordance with strict regulations that CMC Markets follows, the broker provides its clients with negative balance protection, keeps funds in segregated accounts, and is a member of the traders’ compensation scheme.Keep in mind that the negative balance protection is only provided to retail clients to help shield traders against the negative outcomes of margin trading. Margin trading is a highly leveraged activity, which enables traders to trade using borrowed funds and as a result risk money that they do not own. On some occasions, when markets are highly volatile and a trade goes against prediction, it is possible for a trader’s balance to go into the negatives, causing the trader to become indebted to the broker. To counter this, retail traders are offered less leverage, up to 30:1 when trading Forex pairs, compared to professional traders who can use levels going up to 500:1. In addition, the broker uses automatic Stop Out levels to prevent the balance from going negative. Even in the unlikely event that your account goes into a negative, you can contact customer support and they’ll turn the balance from negative to zero.

Something else that is in use is segregated accounts, which increase the level of safety as traders’ funds become inaccessible for the company’s general use and even if the broker goes bankrupt, traders can get their money back.

Assets

CMC Markets offers one of the largest varieties of available Forex pairs for trading. What’s more, the broker provides access to trading both physical and CFD stocks. CFD stands for Contract For Difference and offers various advantages over trading physical assets. On the other hand, physical assets are best for long-term investing as there are no fees for keeping an open position overnight.

CFDs are preferred for short-term investments or speculations as CFDs can be traded in both bullish and bearish markets by going long or short. In addition, CFDs are more liquid and spreads are tighter due to the fact that more people are trading CFDs than actual assets at any given time.

Keep in mind that while CMC Markets offers various trading assets, some of the assets are only available via dedicated account types and the number of assets and policies offered might be a little different depending on your location.

Forex

CMC Markets offers 330 currency pairs for trading. The list consists of Major, Minor, and Exotic pairs. Exotic pairs are less liquid and are characterized by larger spreads. Major pairs such as EUR/USD, USD/JPY, and AUD/USD offer the tightest spreads starting from 0.7 pips. There are no additional fees charged by the broker, only spread markups.

In addition, traders are able to trade currency indices for instance the USD index, EUR index, GBP index, and others.CMC Markets gets liquidity from top global banks for trading Forex such as Deutsche Bank, JP Morgan, Barclays, Goldman, UBS, Citibank, and HSBC.

Shares as CFDs

There are 10,000 shares as CFDs available for trading with CMC Markets. As already mentioned, CFDs are great for speculating on the markets. In addition to other benefits, trading shares as CFDs is available using leverage. For shares leverage offered is up to 20:1.

You can trade Tesla, Google, Amazon, Meta, and other famous company shares as CFDs using a dedicated share trading platform. The fees are reasonable and are starting from 0.10 points on Tesla. What’s more, traders can speculate on Penny stock prices and various instrument types such as growth, technology, banking, ETFs, consumer & retail, as well as share baskets.

Physical shares

Physical shares are preferred by long-term investors as you are not charged any fees for keeping assets long-term. On the other hand, you need more capital to start investing as there’s no leverage available. Overall there are over 35,000 shares available for trading. Keep in mind that you can only profit from trading in one direction. On the upside, trading fees are very reasonable, starting from $0 on US, UK, Canadian, and Japanese markets.

Cryptocurrencies

Cryptocurrencies are constantly becoming more and more popular amongst speculative traders. CMC Markets offers access to 19 major cryptos and alt-coins. Keep in mind that when trading cryptos with CMC Markets, you don’t buy or sell actual coins, you are merely trading these assets as CFDs. As a result, you don’t have to worry about where to cash out profits or how to store them, since you don’t actually own the assets.

CMC Markets charges no commission, however, the broker charges traders with spread markups. The markups for cryptos start from 0.5 pips on MATIC and the spread on the most popular pair, BTC vs USD, starts from as low as 75 pips. The maximum leverage available for crypto trading is 2:1, which is lower than what other brokerages are offering. CMC views cryptos as high-risk products and in an attempt to provide negative balance protection to retail investors, limits the risks.

Indices

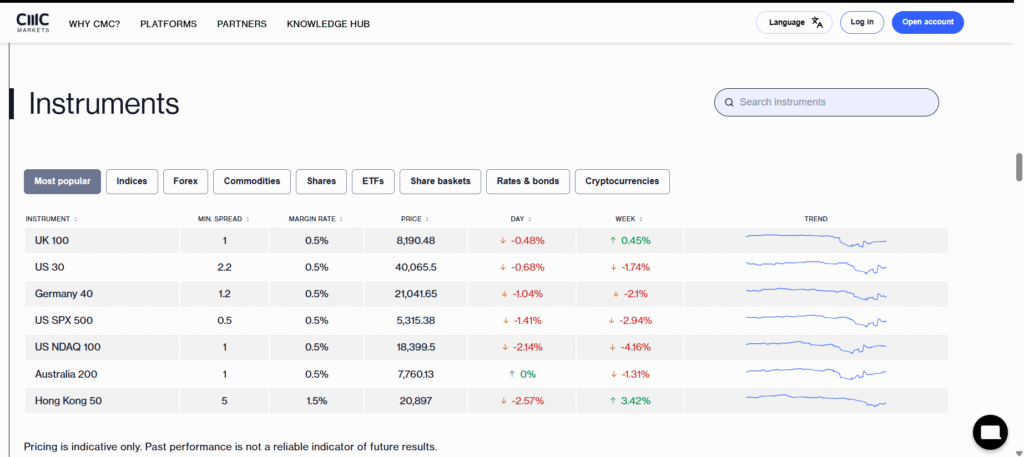

Indices are a very good measure of the health of certain industries and economies. For instance, the S&P 500 measures the performance of the top 500 American companies that are publicly traded in the stock market. You can use the S&P 500 or US 500 as indicators or you can trade them as CFDs.

There are 80 indices available for trading with CMC Markets including the UK 100, US 30, Germany 40, Hong Kong 50, Australia 200, and others. Spreads start from 0.5 pips on the US 500 and the leverage goes up to 20:1.

Commodities

Commodities are raw materials that are used for creating consumer goods and there are two types of commodities that can be found on the markets. The ones that can be grown are called soft commodities while the commodities that are mined are referred to as hard commodities.

With CMC Markets, you can trade both hard and soft commodities including precious metals, energies, agriculture, and commodity indices. Spreads are starting from as low as 0.3 points on gold and natural gas.

Commodity prices are changing based on changes in global demand and supply. Keep in mind that the assets offered are CFDs and you can trade them in both directions.

Account types

CMC Markets offers 2 types of live accounts for trading CFDs; the CFD account and the Corporate account. Both account types are very similar in terms of their offerings, however, the CFD account is for retail traders and the Corporate account is for professionals.

Demo account

Demo trading enables traders to place orders without risking the actual funds. Demo versions of live account types are available for all CFD account types. Demo trading is essential for beginners and professional traders alike. Novice traders are able to get familiar with the trading software and get to know the broker’s policies while more seasoned traders use demo accounts to develop, test, and backtest their trading strategies. It’s worth mentioning that while demo trading is very useful, it cannot fully prepare traders for trading live. Live trading requires managing one’s emotions which comes with discipline and hard work.

CFD account

By using the CFD account traders get access to trading 10,042 products, including over 300 Forex pairs, over 100 indices, over 100 commodities, over 10 cryptos, over 50 bonds, and over 9,000 shares as CFDs.

What’s more, fractional trade sizes are available for both account types. The CFD account type is mainly for retail investors. Leverage numbers vary depending on the asset class. Forex pairs get the highest leverage, up to 30:1. For indices leverage is 20:1. For cryptos 2:1, and for shares 5:1. Keep in mind that leverage is a great tool to increase your profits, however, high leverage can increase your losses too.

Corporate account

The corporate account is for professional traders. As already mentioned, there’s no negative balance protection available, as a result, leverage for trading Forex pairs is limited to 500:1.

On the other hand the account type is very similar to the CFD account version. Both offer the same fee structure, spreads starting from 0.3 points and there’s no commission charged. However, there’s a commission of 7 USD per traded lot round turn when speculating on share CFD prices.

Fees & Commissions

The trading fees are reasonable and attractive with CMC Markets. There are no fees on deposits and withdrawals. Various types of CFDs are charged with different spread markups, and there are no commissions. However, when trading shares, the fee structure is different. There are no spread markups on shares, but traders are charged 7 USD per lot (round turn).

Mobile Experience

CMC Markets provides mobile versions of all its trading platforms. While mobiles are useless in terms of conducting good market analysis due to their tiny screens, they can be quite handy when managing trades in emergency situations such as power outages, lost internet connections, computer breakdowns, etc. What’s more, mobile apps can keep you up-to-date and close to the markets whenever you need them. The apps provided by this broker offer all the necessary tools for analyzing and managing your trading orders.

Education & research tools

CMC Markets offers a wide variety of educational content to its traders. Traders get morning and weekly outlooks, economic calendars, webinars and seminars, and market analyses by various market experts. What’s more, traders can enhance their knowledge through videos by watching platform video guides, trading tips, lessons, and more.

Customer support

CMC Markets offers a great team of customer support specialists. Their responses are swift, friendly, professional, and on the ball when it comes to trading-related questions. However, customer support is only available 24/5 via mobile, while the live chat option is limited and not available 24/5. For many customers live chat is preferable to communication over the phone or via email. Which is an obvious downside.