- No inactivity fees

- Offers access to MetaTrader 4, MetaTrader 5, cTrader, and the ICM Securities trading platforms

- Fast and digital account opening/verification

- Offers access to trading Cryptocurrencies, Energies, Forex, Futures, Indices, Metals, and CFDs on Stocks

- ICM Capital is well regulated in various jurisdictions

- Trading fees are not very competitive

- Micro accounts are not available and minimum deposit required to open an account is 200 USD or equivalent in account currency

- Maximum leverage is limited to 200:1

- Number of available tradable instruments is not significant

ICM Capital was established in 2009 and since then has expanded its financial services globally. Today the CFD and Forex broker serves more than 120,000 active traders worldwide and has received around 20 industry awards.

ICM Capital is well-regulated, being licensed in 7 countries. The broker offers access to trading cryptocurrencies, energies, Forex, futures, indices, metals, and CFDs on stocks. Maximum available leverage is 200:1 and accounts can be opened from 200 USD. What makes this broker stand out the most is that it offers access to quite a few trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and ICM Securities.

In our review of ICM Capital, we’ll dive deep to uncover the broker’s policies, trading conditions, and more. We’ll also guide traders step-by-step in the account opening process and compare the trading fees of ICM Capital with other brokers.

ICM Overview

ICM Overview

| Regulations | Labuan, Mauritius, St. Vincent and the Grenadines, Sweden, Switzerland, UK, Qatar |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 0 USD |

| Minimum deposit | 200 USD |

| Minimum account activation | 200 USD |

| Number of available assets | 159 Including futures |

| Leverage up to | 1:200 |

| Available trading markets | Cryptocurrencies, Energies, Forex, Futures, Indices, Metals, CFDs on Stocks |

| Account currencies | USD, EUR, GBP, SGD |

| Demo account | Yes |

| Live account types | ICM DIRECT (ECN), ICM ZERO |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 42 |

| Shares | 0 |

| Cryptocurrencies | 6 |

| Indices | 9 |

| Commodities | 4 |

| Total | 159 |

| Fees & spread | |

| Forex | From 1.3 pips. On ICM Direct account |

| Shares | N/A |

| Cryptocurrencies | From 0.1% |

| Indices | From 2.5 pips |

| Commodities | From 0.04 pips |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5, cTrader, ICM Securities |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Bitcoin, Credit/Debit Card, Crypto, Neteller, Skrill |

| Minimum deposit | Bank Transfer, Bitcoin, Credit/Debit Card, Crypto, Neteller, Skrill |

| Minimum withdrawal | Bank Transfer, Bitcoin, Credit/Debit Card, Crypto, Neteller, Skrill |

| Withdrawal processing time | instant |

| Time to open an account | – |

Safety & Security

As a trader, your top priority should always be the safety and security of your funds. Financial markets are full of money traps and the best way to make sure that your broker is trustworthy is to check whether it’s regulated.

ICM Capital is a group of Forex brokers operating globally under the same trademark. The broker is well-regulated, in 7 jurisdictions, and therefore can be trusted.

Let’s take a look at the complete list of regulatory bodies, license numbers, and companies under ICM Capital name:

- ICM Capital Limited (UK) is regulated and authorized by the Financial Conduct Authority (FCA) registration number: 520965.

- ICM Jurisdictions In MauritiusICM Capital Limited (MU) is regulated and authorized by the Financial Services Commission of Mauritius under license number: C118023357.

- ICM Jurisdictions In LabuanICM Capital (Labuan) Limited is regulated and authorized by the Financial Services Authority of Labuan under license number: MB/18/0029.

- ICM Jurisdictions In UKICM Capital LLC (VC) is registered by the Financial Services Authority of Saint Vincent and the Grenadines under number: 1853 LLC 2022.

- ICM Jurisdictions In SwissICM House AG (Zurich, Switzerland) is licensed under the supervision of ARIF registration number CHE-497.911.976.

- ICM Jurisdictions In EuropeICM House KB is registered and regulated under the laws of Sweden under the supervision of the Stockholm County Administrative Board with registration number: 969792-7961. SWIFT/BIC: ICHOSES2.

- ICM Jurisdictions In QatarICM LLC (Qatar) is regulated and authorized by the Qatar Financial Centre of Qatar under license number: 00908.

In addition, ICM Capital provides negative balance protection to its clients and keeps funds in segregated bank accounts. We can easily say that traders are in safe hands when registering with this broker.

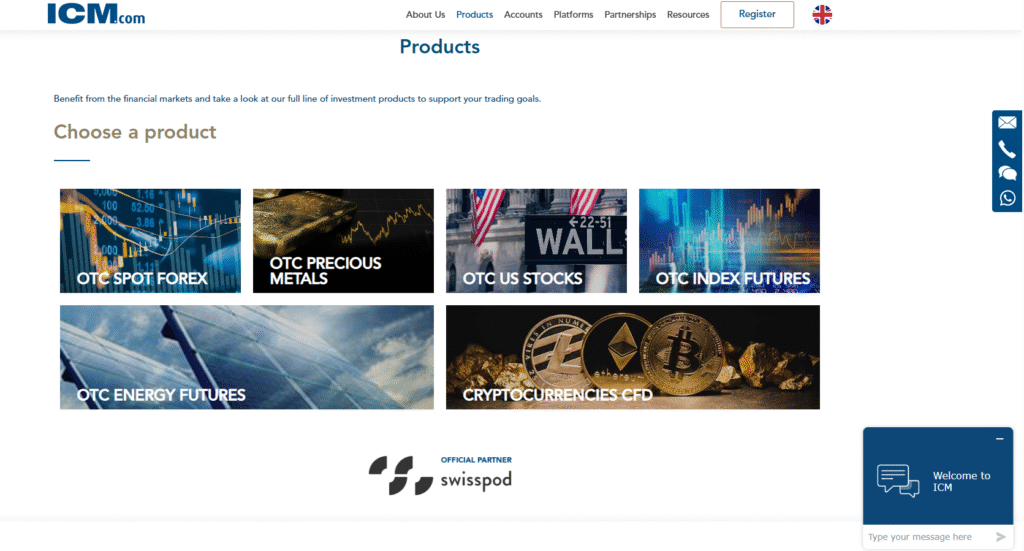

Trading assets

ICM Capital offers a wide range of asset classes to its clients. However, it should be mentioned that the number of tradable instruments is not great compared to competitors. The instruments are contracts for difference (CFDs), which enable traders to speculate on underlying asset prices without the need of owning them. CFDs enable market speculators to use leverage and increase their purchasing power while profiting on both bearish and bullish markets. With ICM Capital the maximum available leverage is 200:1.

Forex trading

There are 42 available currency pairs with this broker, including major pairs that are the most liquid, minors (less liquid than majors), and exotics (the least liquid). It should be noted that while we were reviewing the broker, we noticed outdated information on the broker’s website claiming that there are more than 60 currency pairs available for trading.

The maximum available leverage is 200:1. Currency trading is available through all platforms and account types offered by ICM Capital. However, trading fees differ from account type to account type. On commission-free accounts (ICM Direct) spreads start from 1.3 pips. On spread-free accounts spreads start from 0 pips, on the other hand, there are commissions of 7 USD per traded lot round turn.

Stock CFD trading

CFDs on shares enable traders to speculate on underlying share prices with fewer barriers. In addition, leverage is accessible and trading fees on U.S. shares are 15 cents per share. The broker offers popular company stocks such as:

- Apple Inc

- American Express

- Alibaba

- Bank of America

- Blackrock

- Berkshire Hathaway Class B

- Citigroup Inc

Crypto CFD trading

ICM Capital offers 6 crypto pairs against the USD and one crypto derivative against oil (BTCOIL – Bitcoin v WTI). Trading fees on both selling and buying are 0.1% of the market price.

Crypto vs USD derivatives include:

- BTCUSD – Bitcoin

- BCHUSD – Bitcoin Cash

- LTCUSD – Lite Coin

- ETHUSD – Ethereum

- XLMUSD – Stella Lumens

- EOSUSD – EOS.IO

It should be mentioned that when trading crypto CFDs, traders do not have to worry about crypto wallets or cashouts, since the products are just contracts for difference, profits are added directly to trading accounts.

Commodity CFD trading

With ICM Capital, traders have access to speculating on spot silver and spot gold prices. In addition, there are 3 energies, such as oil and gas available for trading. Commodity prices are largely impacted by global supply and demand.

Indices trading

There are 9 indices, also known as stock indexes, available for trading. Spreads start from 2.5 pips. The list of tradable indices include:

- #DOW30 – US Dow30 Spot Index CFD | USD

- #Euro50 – Euro Stoxx 50 Spot Index CFD | EUR

- #Germany40 – German DAX40 Spot Index CFD | EUR

- #Japan225 – Japan Nikkei225 Spot Index CFD | USD

- #UK100 – UK FTSE100 Spot Index CFD | GBP

- #US500 – US S&P 500 Spot Index CFD |USD

- #USTech100 – US NASDAQ100 Spot Index CFD | USD

- #France40 – France CAC40 Spot Index CFD | EUR

- #Spain35 – Spain IBEX35 Spot Index CFD | EUR

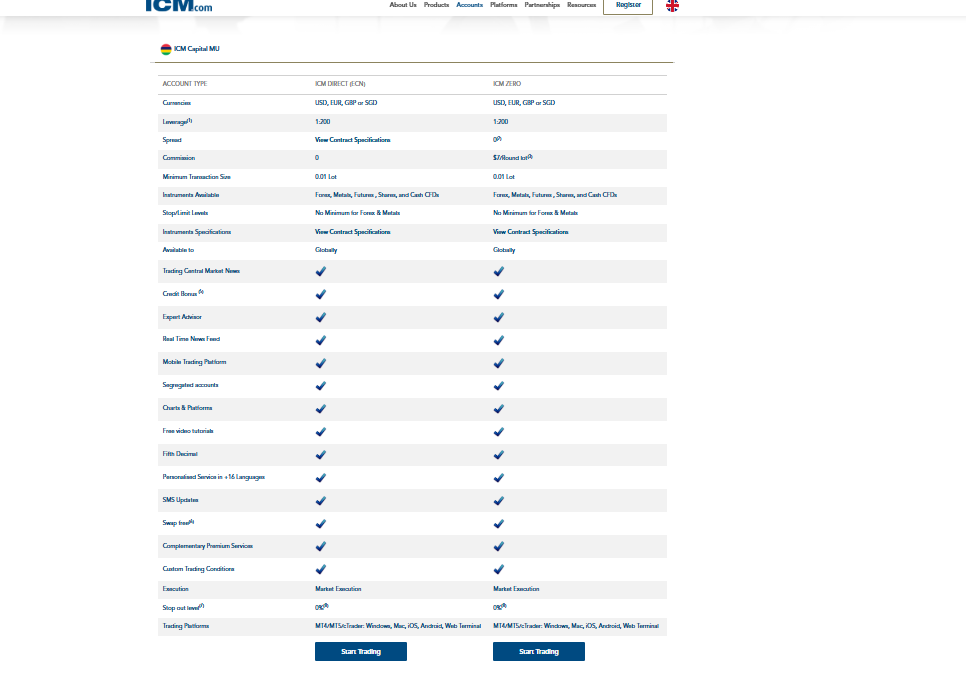

Account types

Account types

Each trader needs a specific account type that meets the requirements of his trading style. ICM Capital offers spread-free and commission-free accounts, along with swap-free (also known as Islamic accounts) and demo accounts also being available.

ICM DIRECT (ECN)In order to open this account type traders need to deposit at least 200 USD or the equivalent in the base account currency. The available account currencies are USD, EUR, GBP, or SGD. Maximum available leverage is 200:1 and the order execution type is market orders. There are no commissions on this account. On the other hand, trading fees are incorporated into spreads and spreads on EUR/USD start from 1.3 pips. This account type is best suited to new traders and swing traders as beginners and position traders typically place fewer trades and not paying commissions is more important to them.

ICM ZERO

There are no spread markups on this account, but on the other hand, commissions are 7 USD per lot per round turn. This account type is best suited for more active traders, such as intraday traders, scalpers, high-frequency traders, algorithmic traders, etc. The ZERO account has many similar features to the DIRECT account with maximum leverage also going up to 200:1 and a minimum deposit requirement of 200 USD. An Islamic account version is available, and Expert Advisors (EAs) are also available on the MetaTrader platforms that can be used for trade automation.

Fees & commissions

Trading fees with ICM Capital are not as low as with industry leaders, however, it should also be mentioned that there are no inactivity fees or fees on deposits and withdrawals, which is always a good thing. In addition, the broker offers both spread-free and commission-free accounts, which makes it possible for different trader types to pick the best fee structure for their strategies.

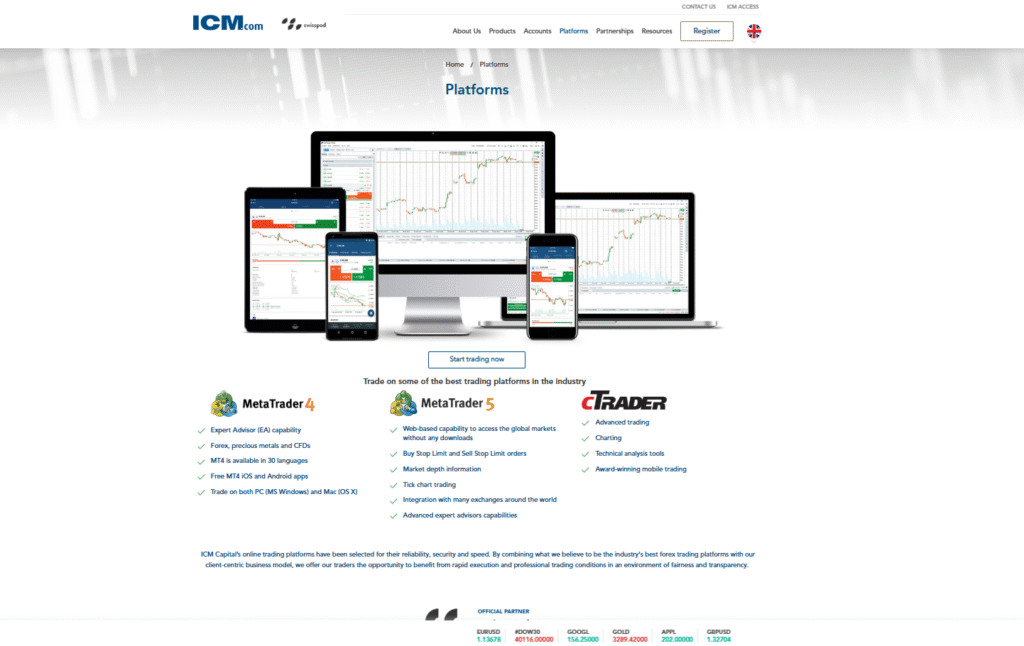

Trading platforms

ICM Capital offers a wide variety of trading platforms to its clients and the full set of MetaTrader platforms are available. In addition, a modern-looking cTrader and the in-house ICM Securities platform are also on offer.

While MetaTrader’s platforms might have an outdated look and feel, both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are extremely reliable and very popular. cTrader has a more modern design and sports a user-friendly interface but is offered by fewer brokers worldwide.

ICM Securities is a web-based platform and also comes as a mobile app. The mobile trading app is available for both Android and iOS users. The mobile app is equipped with all the necessary features traders might need.

Education and research tools

A well-put-together educational material section is essential for any beginner. ICM Capital offers an extensive range of tools and educational resources under the following headings:

- Trading Central

- Trading Tools

- Introduction to Forex articles

- Trading Rules

- Analysis

- Trading Glossary

It should be noted that there are no webinars and online seminars available for traders.

Customer support

ICM Capital offers multilingual customer support that is available 24 hours a day, 5 days a week, during weekdays. Live chat is available straight from the main page and email and phone call options are also accessible.