- Regulated by multiple high authority regulators

- 2,800+ assets from 7 financial markets

- Demo account available

- Variety of educational material

- Consistent mobile app trading

- Only one trading account type is available

- cTrader is not available as well as MetaTrader

- Inactivity fees start after 3 months

Plus500 is a CFD broker with a long history of achievements and success. It is well-known for its sports partnerships with top teams in different countries. It was established in 2008 and worked very hard on updating its services to provide the best trading experience for its users.Plus500 is trusted by more than 22 million traders around the world, handling a trading value of $800 billion in more than 300 million active market positions. There are 2800+ tradable assets available with Plus500, where you can execute different CFD orders on currencies, shares, indices, commodities, ETFs, and options.

This broker is headquartered in Israel, and Plus500 is regulated by top authorities that ensure the reliability of the trading process and that any malpractice is unlikely to take place. Plus500 is characterized by simplicity. There are a few types of trading accounts that you may use, and an easy-to-use trading platform.

Plus500 Overview

| Regulations | Australia, Cyprus, Israel, Seychelles, Singapore, South Africa, UK |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 10 USD per month after 3 months of inactivity |

| Minimum deposit | 100 USD depending on account currency |

| Minimum account activation | 100 USD |

| Number of available assets | 2,800+ Offers CFDs |

| Leverage up to | 1:30. Leverage can be lower in some parts of the world |

| Available trading markets | CFDs on Stocks, Commodities, ETFs, Forex, Indices, Options |

| Account currencies | EUR, USD, GBP |

| Demo account | Yes |

| Live account types | Live account |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 66 |

| Shares | 1200 |

| Cryptocurrencies | N/A |

| Indices | 31 |

| Commodities | 22 |

| Total | 2,700+ |

| Fees & spread | |

| Forex | From 0.8 pips (info from 30/09/2022 12:54) |

| Shares | From 0.75% 0.75% Avg. Spreads on Tesla (info from 30/09/2022 12:54) |

| Cryptocurrencies | N/A |

| Indices | From 0.7 (info from 30/09/2022 12:54) |

| Commodities | From 0.04 (info from 30/09/2022 12:54) |

| Software | |

| Platforms | Plus500 WebTrader |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Credit/Debit Card, PayPal, Skrill |

| Minimum deposit | Bank Transfer, Credit/Debit Card, PayPal, Skrill |

| Minimum withdrawal | Bank Transfer, Credit/Debit Card, PayPal, Skrill |

| Withdrawal processing time | Instant Withdrawals take up to 7 business days |

| Time to open an account | – |

Reliability & Regulations

Plus500 is a UK LTD is a fully operating subsidiary of Plus500 Ltd, the headquarters company is based in Israel. Unlike other online trading brokers, Plus500 does not relocate its operations offshore as it’s operating from the middle of Europe.

Therefore, Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FRN 509909 The FCA directly supervises the activities of this broker and imposes hefty penalties in case of any violations of the set rules. That makes the broker obliged to abide by the guidelines of this legislation.

In addition to the local authoritative body, there are several regulators that authorize Plus500 to operate legally in other countries such as

- Cyprus Securities and Exchange Commission (CySEC) (Plus500CY Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (Licence No. 250/14))

- Australian Securities & Investments Commission (ASIC) (Plus500AU Pty Ltd holds AFSL #417727 issued by ASIC)

- Financial Markets Authority in New Zealand (FMA) (Plus500AU Pty Ltd holds FSP No. 486026 )

- Financial Sector Conduct Authority in South Africa (FSCA) (Plus500AU Pty Ltd holds A#47546 issued by the FSCA in South Africa)

- The Monetary Authority of Singapore for dealing in capital markets products (Plus500SG Pte Ltd (UEN 201422211Z) holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products (License No. CMS100648))

- the Seychelles Financial Services Authority (FSA) (Plus500SEY Ltd is authorised and regulated by the Seychelles Financial Services Authority (Licence No. SD039))

The broker also discloses the registry number of the license on the website, and after we checked these licenses, we found out that they are all active and valid documents. Therefore, we validated that the above-mentioned licenses are truly functional under the Plus500 name.

Global Partners

Plus500 is known for its global partnerships with different organizations. This way, the broker promotes its services across different regions.

Major sponsorship with sports teams makes Plus500 reliable, taking into account that these football teams will only partner with a legit entity, indicating that Plus500 is trusted by global organizations.

Cooperating with top football teams from Spain (from 2015 until 2022), Switzerland, and Poland is a great indicator of the broker’s reliability and trust. Also, Plus500 partners with different financial newspapers like FX Empire, finanzen.net, and money.it to promote its service and reach those who are interested in financial news.

Assets

There is a huge variety when it comes to tradable products with Plus500. A trader with a Plus500CFD account can trade CFDs on Forex, Stocks, Commodities, ETFs, Options and Indices.

In total, there are more than 2800 securities. In every financial market, there is different maximum leverage allowed according to the regulations, and variable spread that can be as small as 0.00008 pips for the EUR/USD pair, we found that on average, spreads on EUR/USD is around 0.8 pips (info from 30/09/2022 12:54).Executing market orders is straightforward, you can directly see the price changes of each financial asset once you click on it, and the broker predetermines the ground rules for placing any order such as minimum contract size, minimum tradable amount, and the max spread.

Forex

You can trade 66 currency pairs in the largest financial market. It is possible to execute orders with major, cross, or exotic currencies to maximize your gains.

However, if you are not familiar with Forex trading, Plus500 will take you through the basics of currency trading until you become an independent Forex trader. The maximum leverage allowed is 1:30, which means that if you place a market order worth $3,000, you only need to invest $10, and the broker will lend you the remaining amount to give you 300 times the purchasing power.

Stocks

Trading shares is popular for those who are looking for a long-term investment, and Plus500 offers more than 1,200 stocks of international organizations from different countries. This huge variety of stocks includes corporations from the US, UK, EU countries, Australia, Japan, Hong Kong, and many other locations. This gives the trader a huge advantage of speculating on the economical development of different countries, then buying and selling shares of different companies.

Since there is no direct market access, Plus500 stock trading is done through CFDs which is a popular trading option. Trading on margin can be done using leverage up to 1:5, which means that you can turn a $100 investment into a $2,000 investment.

Indices

Trading indices might be similar to trading stocks, but some traders consider it a safer option. Plus500 offers 31 indices from different locations. You can find US indices, UK indices, and European indices, as well as the Cannabis stock index.

The Dow Jones and NASDAQ are among the most traded price indices, and you can execute market orders on any index using a maximum leverage of 1:20.

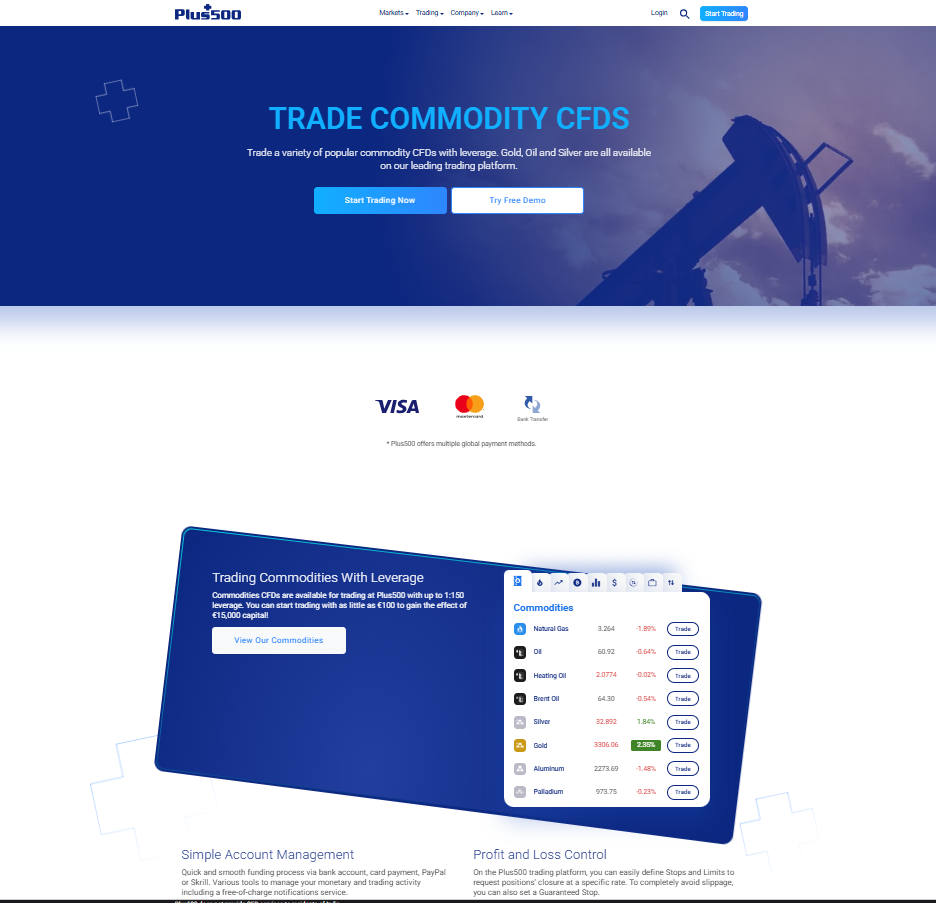

Commodities

There are 22 commodities that you can trade, including the most commonly traded goods like natural gas and oil, as well as less traded commodities like cotton and sugar. Trading commodities became popular due to market volatility and rapid market execution using CFD contracts. You can trade with borrowed funds from the broker and maximum leverage of 1:20, which may change according to local legislation.

If commodity trading is something new for you, don’t worry, Plus500 will lead you through the best trading strategies for commodities, and will guide you on reading the commodity markets.

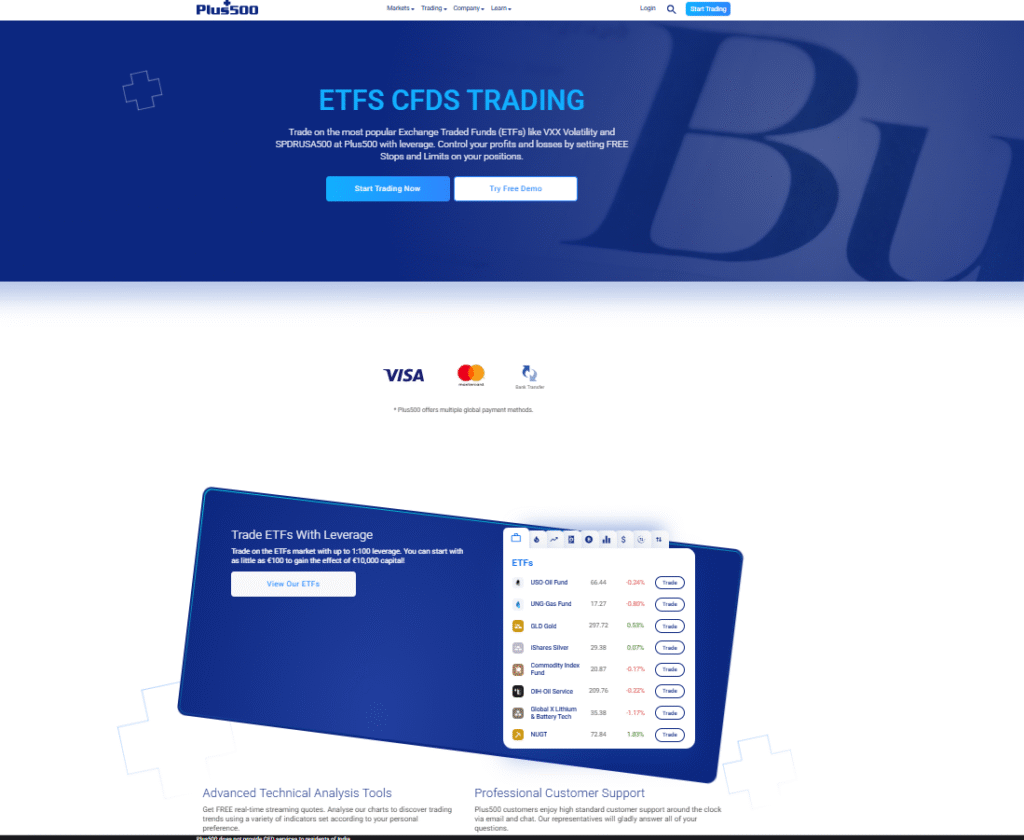

ETFs

Some traders prefer Exchange Traded Funds because they can be less risky. They include different assets in one basket, and these assets are usually taken from the same industry.Plus500 enables you to choose from the top ETFs that are traded in global markets, such as SPY ETF and QQQ. Plus500 offers a wide selection of more than 80 ETFs.

Additionally, you can utilize Plus500 leverage of up to 1:5, which is a great way to improve your market position using this trading option.

Trading Accounts

Plus500 uses simplicity in its offers. Therefore, you will find only one type of live trading account, besides the demo account. Some traders prefer having only one trading account because it makes it easier for them to choose.

Having one type of account makes it easier for the broker to focus on providing excellent trading services, where the commission system is the same for every trader on the website.

Live trading account

Plus500 focuses on its services and as such has only the type of trading account. You can start trading with a low minimum deposit requirement of $100, and tight spreads starting from 0.00008 pips (taken at 10:29 20.02.2022) for the currency pair EUR/USD. The accepted currencies in this account are USD/EUR/GBP.Using this account, you have access to more than 2,000 financial assets to grow your capital while using leverage of up to 1:30. However, the maximum leverage can vary depending on your location and the jurisdiction of financial trading in your area.

There are no fees on deposits or withdrawals. Also, there are no trading costs every time you enter or leave the market. What’s more, traders will not see any rollover (swap) charges, which gives Plus500 a greater edge over other brokers.The only way the broker earns money is through the spread. Plus500’s spread is variable across the financial assets, and the broker offers one of the tightest spreads in the market, starting from 0.00008 pips (taken at 10:29 20.02.2022).

Demo account

The Demo account is a great help for every trader, and traders on Plus500 enjoy the additional benefits of this type of account.

When you start demo trading, you are given virtual money that you can use to practice trading, and once your balance drops to 200 Euro, the balance will be refilled automatically, to ensure you never run out of money. That way, you can always keep practicing your trading strategies. The Plus500 demo account has no expiration date, which means that you can use it as long as your account is active.

When you register for the first time, you can start with a demo account or a live account, and it is possible to switch between these two whenever you want. If you start with a live account and discover that you need some practice, you switch to the demo account without a problem.

Fees & Commissions

Plus500 fees are simple and you can find a dedicated page to clarify every type of charge you will encounter. The spread is the only type of trading-related charge, while other types of fees include overnight funding, currency conversion fee, guaranteed stop order, and inactivity fees.

Plus500 has just one type of real trading account, considering the demo trading account does not have any fees, which makes it easier to understand the type of charges that take place.

However, we will go about the fees of the broker in detail. We will even discuss the ones that are waived by the broker, to learn how Plus500 handles these fees and how your account is affected.

Trading fees

There are no fixed fees every time you open or close a trading position in the market. Most brokers get their money from the spread, making the most out of the difference between the bid and ask price.

This fee is not charged separately, it is rather incorporated in the price at which you place your market order, whether you are executing a buy or sell order.

However, this does not mean that the broker adds a huge markup on the market prices. Plus500’s spreads are some of the smallest spreads in the market starting from almost 0 pips on major Forex pairs (0.00008 pips taken at 10:29 20.02.2022 for the currency pair EUR/USD).

Trading Platforms

Plus500 has only one trading platform available, which is the Plus500 Webtrader trading platform. However, it is still an excellent choice for every trader using the website. The Plus500 Webtrader is well-designed to suit every trader’s needs. It focuses on enabling the user to fully control their trading view with more charting options, sentiment analysis, and setting alerts.

Some traders prefer the Webtrader because it does not require installing an application on the PC. A trader may directly open the trading terminal after logging in to the trading account.

Mobile Experience

Plus500 offers a native app that you can download on mobile devices. The app allows you to track your trades and interact in a simple way. You can watch the market signals, place trade orders, and conduct transactions between your accounts.

However, the app lacks advanced tools that experienced traders use. The charts do not sync with the live price chart, and you might face some delays when you execute some market orders. Therefore, you can download the application for Android and Windows, and use it for simply tracking your money and your market orders.

Education & Research

Plus500 offers several tools for traders to learn and implement during their trading activities. The market insight page includes articles and analyses about market activity every day, which helps the trader understand their next trading step.

Additionally, there are tutorial videos that teach about some trading terms and events like rollover and margin. However, there are only 10 videos that broadly discuss trading, and doesn’t qualify as a proper trading course for beginners.

Customer Support

You can find a reliable source of information in the Plus500 support section. The largest support tool is the FAQ page, where you can find answers to more than 50 topics, divided into several sections. You can also find in-depth information about the trading platform and regulations.

However, if you were unable to find your answers on the FAQ page, you can refer to the online query form, where you type your question and select the department you want to address, and the customer support team will respond. Typically, you can write your query 24/7 and you can expect to receive the answer within 24 hours.