- Offers excessively high leverage and limited educational resources increasing risks for beginner traders

- Multiple negative reviews regarding issues with withdrawals

- There are inactivity fees

FXGT or sometimes the 360 Degree Markets is a regulated Forex and CFDs broker offering over 186 trading instruments across diverse asset classes such as Forex pairs, cryptos, stocks, indices, commodities, synthetic tokens, defi tokens, and NFTs.

FXGT Overview

| Regulations | Cyprus, Seychelles, South Africa, Vanuatu |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 10 USD after 90 days of inactivity |

| Minimum deposit | 5 USD |

| Minimum account activation | 5 USD |

| Number of available assets | 186 |

| Leverage up to | 1:- |

| Available trading markets | Forex, Stocks, Cryptocurrencies, Indices, Commodities |

| Account currencies | BTC, ETH, USDT, ADA, XRP, EUR, USD |

| Demo account | Yes |

| Live account types | Mini, Standard+, Pro, ECN |

| Islamic account | Yes |

| Security | |

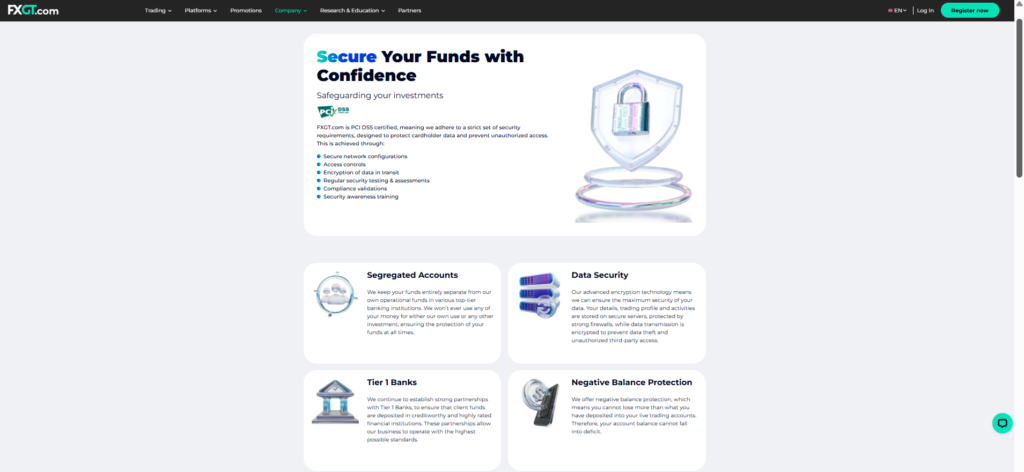

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | |

| Shares | |

| Cryptocurrencies | |

| Indices | |

| Commodities | |

| Total | – |

| Fees & spread | |

| Forex | From 1 pips |

| Shares | – |

| Cryptocurrencies | – |

| Indices | – |

| Commodities | – |

| Software | |

| Platforms | – |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | – |

| Minimum deposit | – |

| Minimum withdrawal | – |

| Withdrawal processing time | – |

| Time to open an account | – |

Safety & Security

There are very few Forex brokers out there with as many licenses and regulatory oversight as FXGT. Still, the broker is not offering its services to retail clients in all jurisdictions. The broker is under regulations by

- The Seychelles Financial Services Authority (FSA)

- The Financial Sector Conduct Authority South Africa

- The Vanuatu Financial Services Commission (VFSC), but company does not retail clients under Vanuatu jurisdiction only financial and investment services exclusively to eligible counterparties

- The Cyprus Securities and Exchange Commission (CySEC), only eligible counterparts and not retail clients under Cyprus either.

Account types

When it comes to trading accounts FXGT offers several trading account styles catering to the needs of diverse trading styles and methods. These accounts are Pro, ECN, Standard+, and Mini.

Pro account comes with 20% stop-out levels, an Islamic account option, and all trading asset classes offered by the broker. Spreads start from 0.5 pips, there is a zero USD commission, leverage is up to 1:1000, minimum deposit size is set to 5 USD, the minimum lot size starts from 0.01 lots, and margin call is set to 50%. The Pro account can be operated using any trading platform including MT4, MT5, web, and mobile trading apps which is very flexible. Spreads are very competitive also.

ECN account targets traders who want to make very short-term trading positions and offers spreads from zero pips. Margin call is set to 70%, and stop-out happens at 40%, meaning traders must be extra cautious when using this account as stop-out can happen very quickly with 1:1000 leverage levels. The minimum deposit size is also set at 5 USD and the minimum lot size is set to 0.01 lots. ECN account got a volume-based trading commission to account for zero pips spreads it offers. The commissions are 6 USD to all Forex instruments, 5 USD round turn for precious metals, and 0.1% round turn for cryptos.

The third account type is called a Mini account and it is targeted at beginners with a middle ground of terms. The commissions are zero, spreads start from 1 pip on major pairs, and the minimum deposit is also set at 5 USD. Maximum leverage is capped at 1:1000 which is more than enough for beginners to start with tiny trading capital. There are various deposit bonuses and promotions available for the mini account as FXGT is trying to attract newcomers with this account type.

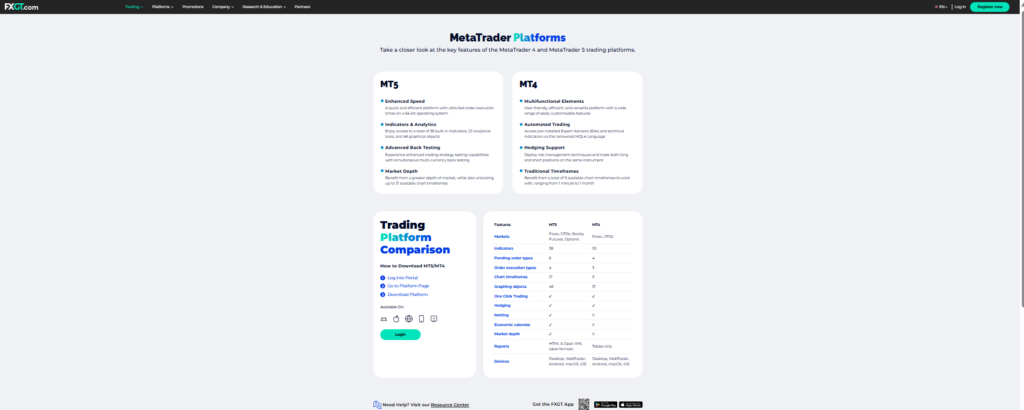

Trading platforms

All trading accounts offered by FXGT come with MT4 and MT5 advanced trading platforms that are available on all devices. This will enable FXGT traders to possess astounding flexibility to conduct both manual and automated trading with ease.

Mobile apps are for both Android and iOS and come with inbuilt technical indicators and advanced functionality to analyze markets on the go.

Education and research tools

Educational resources are limited and only glossaries and eBooks are offered. However, FXGT excels with abundant market research tools and insights. With VPS sponsorship traders will be able to run their favorite EAs 24/5 without limitations from anywhere in the world.

Additionally, MQL5 trading signals, trader insights, technical analysis, economic calendar, holiday calendar, and glossary are all offered. With these tools and educational resources, even beginners can feel comfortable to start making sense of financial markets.

Customer support

All forms of support channels are offered and they are multilingual together with the website. This enables traders of diverse origins to get needed assistance in their language and solve issues faster. Live chat, hotline, email support, and online form should be sufficient to resolve issues if any arise.