- Regulated in 3 jurisdictions

- Offers access to MetaTrader 4, MetaTrader 5, and ActiveTrader

- Charges no inactivity fees

- Offers access to over 1,100 tradable assets

- Low fees

- Fast and digital account opening/verification

- 24/5 customer support. Available in 14 languages.

- High minimum initial deposit requirements.

- Limited amount of account types.

This Forex broker was established in 2001 and since its creation has managed to expand its customer base to more than 140 countries. ActivTrades offers various tradable asset classes to its clients. The list includes Forex pairs, indices, commodities, ETFs, and over 1,000 share CFDs. The broker offers access to the MetaTrader platform as well as in-house-built ActiveTrader software.ActivTrades serves its customers from offices located in various places including Milan, Nassau, Sofia, and Luxembourg. Their headquarters is located in London.

The broker is regulated by top-tier regulatory bodies, therefore is considered safe. However, the number of financial institutions that license the broker is limited to only 3. The list of regulators reads as follows: the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg, the Financial Conduct Authority of the UK, and the Securities Commission of the Bahamas.

ActiveTrades Overview

| Regulations | Bahamas, Luxembourg, UK |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 0 USD |

| Minimum deposit | 500 USD |

| Minimum account activation | 500 USD |

| Number of available assets | 1,100+ |

| Leverage up to | 1:200 |

| Available trading markets | CFDs on Stocks, Commodities, Cryptocurrencies, ETFs, Forex, Indices |

| Account currencies | EUR, USD, GBP, CHF |

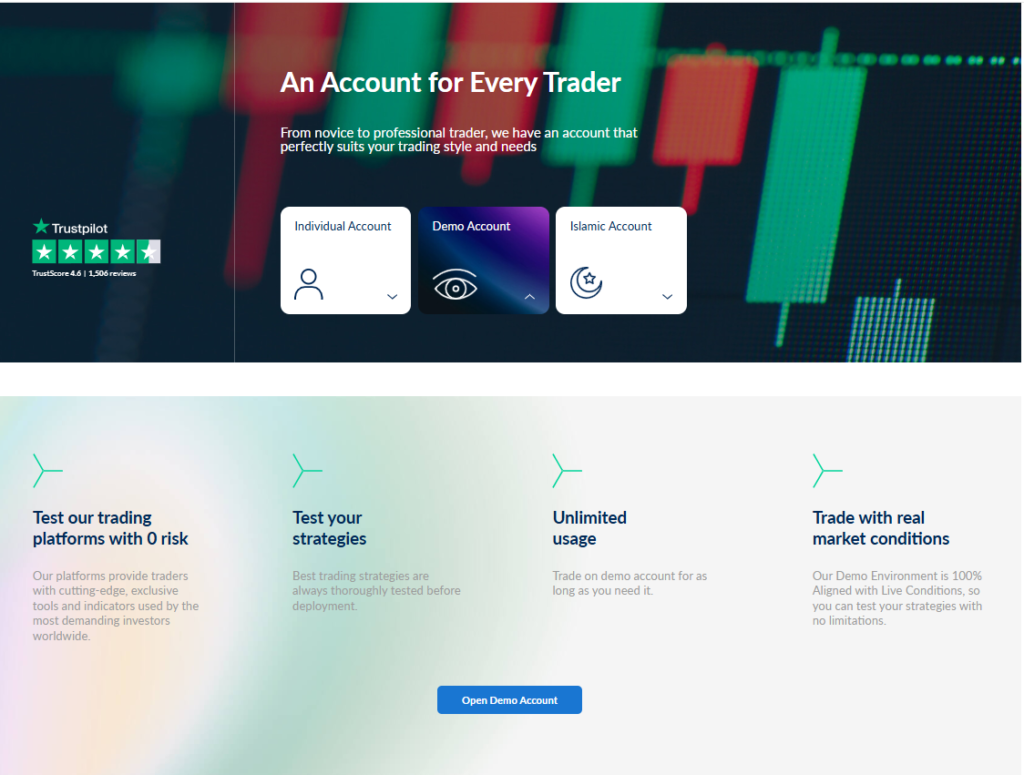

| Demo account | Yes |

| Live account types | Individual account |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 50 |

| Shares | 0 |

| Cryptocurrencies | 16 |

| Indices | 14 |

| Commodities | 18 |

| Total | 1,100+ |

| Fees & spread | |

| Forex | From 0.5 |

| Shares | N/A |

| Cryptocurrencies | From 0.0018. 83.99 Avg spread on BTC/USD |

| Indices | From 0.23. 0.33 Avg spread on US500 |

| Commodities | From 0.0003. Spreads on Gold start from 0.25 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5, ActivTrader |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Credit/Debit Card, Neteller, PayPal, Skrill, Sofort |

| Minimum deposit | Bank Transfer, Credit/Debit Card, Neteller, PayPal, Skrill, Sofort. Card payments are charged by 1.5% of the amount. |

| Minimum withdrawal | Bank Transfer, Credit/Debit Card, Neteller, PayPal, Skrill, Sofort. Bank Transfer withdrawals cost 9 GBP. Other options are free. |

| Withdrawal processing time | Up to 30 minutes. Bank transfer takes up to 1 working day |

| Time to open an account | – |

Safety & Security

Everyone can agree that the most important aspect to look for in a broker is safety and security. What guarantees the safety of your hard-earned money? There are a couple of indications that can tell whether your broker can be trusted or not.

The first and foremost indication is tight regulations. ActivTrades is tightly regulated by:

- Financial Conduct Authority of the UK (FCA).

- The Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg.

- The Securities Commission of the Bahamas (SCB).

Top-tier regulators like FCA and CSSF have strict licensing requirements in place to protect your interests. For instance, regulations make brokers fully disclose risks associated with trading to their clients. In addition, money withdrawal requests get processed instantly and that can save a lot of time and energy.

Trading Assets

ActivTrades offers more than 1,100 tradable instruments from various asset classes. Including Forex pairs, indices, commodities, ETFs, and over 1,000 Stock CFDs.

Most of the offered portfolio consists of CFDs. CFDs are Contract For Difference and trading these asset classes can give you a number of advantages compared to trading actual assets.

The advantages of trading CFDs are:

- High liquidity. For instance, you can buy and sell gold CFDs more easily than actual gold. As a result, you will experience lower spreads and faster execution.

- CFDs give you the ability to benefit from the price moving in both directions, be it upward or downward.

- Low fees for short-term trading.

Forex trading

Initially, ActivTrades started out as an FX broker and only later expanded its asset offerings to stock CFDs, commodities, indices, etc.

As of today, the broker offers 50 available Forex pairs including:

- Majors (EUR/USD, GBP/USD, USD/CAD, CAD/JPY, GBP/CAD, etc.) – spreads start from as low as 0.5 pips.

- Minors (AUD/USD, NZD/CAD, NZD/USD, AUD/CAD, EUR/AUD, etc.) – spreads start from as low as 0.6 pips.

- Exotics (EUR/NOK, USD/MXN, USD/PLN, USD/ZAR, etc) – spreads start from 5.9 pips.

Stock CFD trading

As already mentioned, there are certain advantages and disadvantages to trading stock CFDs. ActivTrades offers access to US, UK, and European stock CFDs.

Leveraged stock CFD trading brings additional fees to the table. Such as:

- 1 Euro/month market data charge for American and all European markets.

- Commission: $0.02 per US share, $0.1 per UK share, and $0.01 per European share.

- The minimum charge for US stock CFDs is $1. Similarly 1 GBP for UK stocks and 1 Euro for European ones.

Indices trading

Indices are index baskets of certain companies that measure their collective performance. With ActivTrades, you can trade GER40, UK100, USA500, USAIND, USATEC, and more. Indices not only show the collective health of an industry or country’s economy, but they are also widely traded in financial markets as CFDs.

What’s more, even if you don’t plan to trade indexes, it’s nice to have them on your watchlist. Stock traders use certain indexes as indicators for technical analysis. As for FX traders, certain indexes can help predict the strength of currencies.

Commodity CFD trading

Commodities are raw materials. Later commodities are transformed into consumer goods. In general, commodities are viewed as immune to inflation and their prices are mainly influenced by supply and demand. There are various ways you can invest in commodities:

- Buy commodities or commodity CFDs.

- Invest in companies that mine or grow commodities.

ActivTrades provides access to 18 commodities and commodity futures, such as COCOA, COPPER, NGAS, DIESEL, CORN, COTTON, etc. Spreads for crude oil and Brent oil start from 0.03 pips (in points).

Crypto CFD trading

Cryptocurrencies have become very popular among financial speculators recently due to their high volatility. ActivTrades offers access to trading the 16 most popular crypto CFDs, including BTC/USD, ETH/USD, LTC/USD, BCH/USD, DOT/USD, EOS/USD, LINK/USD, XLM/USD, NEO/USD, ADA/USD, and DOGE/USD, etc.

By trading crypto CFDs instead of actual cryptocurrencies, you get a number of advantages.

- ActivTrades charges no commissions for trading crypto CFDs. And spreads start from 0.002 pips.

- You can go long or short and benefit from the market moving in either direction.

- No risk of theft. You have no risks associated with storing actual cryptos.

- Easy to cash out. Liquidity in the CFD market is higher, therefore cashing out is no problem. Moreover, you don’t have to worry about crypto wallets or look for crypto ATMs.

Provided leverage for trading crypto CFDs is up to 10:1, which is higher with this broker than what other brokers are offering. Most Forex brokers provide leverage of up to 5:1.

Account Types

Demo Account

Demo trading comes with certain benefits for all sorts of traders. Novice traders use them to get familiar with using platforms, conduct technical analysis using indicators, and develop basic trading skills. Professional traders demo test new strategies and ideas before risking real money. ActivTrades offers free Demo accounts for both Islamic and Individual account types. The platforms offered are MetaTrader 4, MetaTrader 5, and ActivTrader.

Each account comes with a preselected amount of money. Namely $10,000. This practice is not common among other brokers. Usually, brokers let you choose your preferred amount since it’s only virtual money.

Individual Account

As already mentioned, the broker only offers Individual and Islamic account types. The minimum initial deposit required to open the individual account is $1,000. Which is pretty high compared to other brokers. There are 4 account currencies you can choose from, USD, EUR, GBP, and CHF. If you use Euro on a daily basis, it’s better to choose EUR as an account currency to save on conversion fees when withdrawing or depositing money.

As for the fees, as already mentioned the account has low fees. Spreads are starting from 0.5 pips on major pairs and no commission is charged. In addition, the broker has no inactivity fees or deposit and withdrawal fees, which makes ActiveTrades attractive. In addition, the leverage offered goes up to 200:1. Traders can choose between MetaTrader 4, MetaTrader 5, and ActivTraders platforms.

Islamic Accounts

In order to enable religious Muslim traders to place orders without going against the teachings of the Quran, ActivTrades offers a swap-free account type. The minimum initial deposit required for an Islamic account is $500. On the downside, traders do not have access to the ActivTrader software. Only MetaTrader 4 and MetaTrader 5 are available for this account.

In addition, MT4 only uses USD as an account currency. Whereas MT5 enables choosing between USD, EUR, GBP, and CHF account currencies.As for the fees, the broker does not charge additional rollover commissions for contracts lasting longer than a day. What’s more, spreads for this account type are starting from 5 digits and leverage goes up to 200:1.

Fees & Commissions

Fees charged by ActivTrades are low compared to the industry average. Spreads start from as low as 0.5 pips on major pairs and there’s no commission charged. Spreads for minor pairs start from 0.6 pips.

Furthermore, the broker doesn’t charge clients inactivity fees or deposit and withdrawal fees. However, be informed that deposits made by debit/credit cards are charged a 1.5% fee and withdrawals through bank transfer are charged 9 GBP per request.

Trading Platforms

The broker provides access to various platforms. Traders can choose from MetaTrader 4, MetaTrader5, and ActivTrader. All of these have their own unique characteristics, so let’s discuss them in detail to make choosing easier for you.

MetaTrader 4 is a widely known trading platform used by Forex traders globally. The platform was released in 2005 and quickly gained popularity. As a result, you can find vast amounts of algorithms or Expert Advisors developed for this software. The EAs help to automate trading.

MetaTrader 5 was released in 2010 and is based on the MetaTrader 4 platform. MT 5 is more complex and offers access to various asset classes such as FX pairs, commodities, indices, stocks, and more. Whereas MT4 is more dedicated to Forex trading.

The ActivTrader platform was developed by the broker itself. The software gives access to all of the instruments offered by the company for trading. The platform is more modern looking than MT4 or MT5.

Mobile Trading

ActivTrades provides access to mobile trading through MetaTrader 4, MetaTrader 5, and the ActivTrader mobile app. All of the apps are accessible on App Store and on Google Play. In addition, ActivTrader offers a web trading option.

Various trading apps increase connectivity between traders and financial markets. Mobile apps make trading on the go available. In addition, they help monitor your positions from anywhere on the globe where there’s an internet connection.

Education and Research Tools

Quality education is essential for every trader. Trading platforms are complex and there are an infinite number of trading strategies. Well-put-together educational material can speed up the learning curve.

ActivTrades provides access to various educational materials including seminars, one on one training, webinars, a webinar archive, a trading glossary, educational videos, and educational manuals. Moreover, the broker provides an economic calendar and in-depth market analysis to its clients.

Customer Support

The establishment and development of great customer relationships are essential for every company’s success. ActivTrades provides a professional and friendly team of customer service agents that are accessible 24/5.

There are numerous ways you can reach out to the company. You can send them an email, call or request a callback, and chat online. A chat option is available via WhatsApp, Telegram, and the company’s website.