- Regulated in three jurisdictions

- Offers access to MetaTrader 4, MetaTrader 5, and TickTrader

- Fast and digital account opening/verification

- Offers access to over 2,000 trading instruments

- Low trading fees

- Offers crypto account

- Offers micro account

- Wide range of account types to choose from

- The minimum initial deposit starts from $1

- Charges fees on deposits

- Charges an inactivity fee of $10 after 3 months of inactivity

- Charges fees on withdrawals

- No Visa payments available (It was available in the past)

- STP account-type floating fees are not transparent

FXOpen was established in 2005. The broker first started to offer micro and swap-free accounts in 2006. Since its creation, the company has grown dramatically and nowadays serves more than a million customers worldwide.

The broker provides access to more than 2000 trading instruments globally. These include Forex pairs, CFDs on shares, ETFs, cryptocurrencies, indices, and commodities. What’s more, the broker offers various account types and competitive spreads to its clients.

FXOpen companies are regulated across the world by top-tier financial institutions. The list includes the Financial Conduct Authority of the UK, the Cyprus Securities and Exchange Commission, and the Australian Securities and Investments Commission. Due to the impressive list of high-trust regulators, FXOpen is considered safe.

FXOpen Overview

| Regulations | Australia, Cyprus, UK |

| Fees on deposits | 7% + 0.15 USD/EUR For Mastercard option |

| Fees on withdrawal | – |

| Inactivity fees | 10 USD per month after 3 months of inactivity |

| Minimum deposit | 1 USD. 10 USD for Crypto and STP accounts. 100 USD for ECN |

| Minimum account activation | 1 USD |

| Number of available assets | 600+. 2000+ instruments globally |

| Leverage up to | 1:500. 3:1 for Crypto |

| Available trading markets | CFDs on Stocks, Commodities, Cryptocurrencies, Forex, Indices |

| Account currencies | EUR, USD, GOLD, AUD, CHF, GBP, JPY, RUB, SGD, mBTC |

| Demo account | Yes |

| Live account types | Micro, STP, ENC, Crypto |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 50 |

| Shares | 0 |

| Cryptocurrencies | 43 |

| Indices | 13 |

| Commodities | 5 |

| Total | 600+ |

| Fees & spread | |

| Forex | From 0. $1.5 commission on ECN account |

| Shares | N/A |

| Cryptocurrencies | 0.00250.25% on ECN account |

| Indices | From 0.7 |

| Commodities | From 0.01 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5, TickTrader |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | AdvCash, Bank Transfer, Credit/Debit Card, Crypto, Fasapay, Trustly, WebMoney |

| Minimum deposit | AdvCash, Bank Transfer, Credit/Debit Card, Crypto, Fasapay, Trustly, WebMoney. Some methods are unavailable in some countries |

| Minimum withdrawal | AdvCash, Bank Transfer, Credit/Debit Card, Crypto, Fasapay, Trustly, WebMoney. Some methods are unavailable in some countries |

| Withdrawal processing time | Up to 1 hour. Most withdrawals take 1 business day |

| Time to open an account | – |

Safety & Security

There are various things to consider when choosing your broker. For instance fees, safety, trading software, the list of tradable assets, and more. Among many important aspects, the number one priority is the safety and security of your hard-earned money.

What can guarantee the safety of your funds? The answer is regulations. FXOpen is regulated by the Financial Conduct Authority of the UK, the Cyprus Securities and Exchange Commission, and the Australian Securities and Investments Commission. FXOpen is a global company, which means in certain countries, such as Australia, the broker operates under the supervision of the ASIC. Meanwhile, in the UK, the accounts are opened under FCA regulations.

- In the UK the broker is operating as FXOpen LTD.

- Europe: FXOpen EU LTD.

- Australia: FXOpen AU PTY LTD

- Internationally: FXOpen Markets Limited

Policies

FXOpen provides negative balance protection for clients from the UK, Australia, and Europe. Unfortunately, international traders should use stop-loss and other tools to protect themselves from going negative. Whether you trade Forex or other assets when using leverage to speculate on the markets, you are using borrowed money. As a result, there’s a chance for you to lose more money than is in your bank account.

In addition to the negative balance protection, the broker keeps clients’ funds in segregated accounts, but not for international traders. Many low-trust brokers mix clients’ funds with their own and in the event of bankruptcy, traders might lose everything. Segregated funds increase the safety of your money.

Assets

Trading assets offered by FXOpen vary depending on your account type and region. In addition, some trading software, like TickTrader and MetaTrader 5, offers access to a wider range of assets. You can trade cryptocurrencies using various platforms from every account type. However, if you want to solely trade cryptos and access the largest pool of trading symbols, you should open a dedicated crypto trading account that offers up to 43 coins.

Most of the portfolio consists of derivative products, aka CFDs, which means that you don’t actually own the stock when you press the buy button. You simply speculate on the price changes you expect and benefit from price going up or down by going long or short. In addition, liquidity and spreads are much better for CFD trading, and brokers give higher leverage when trading these.

Forex

One of the main reasons why people trade on Forex markets is that the market is the largest and the most liquid in the world. High liquidity guarantees tight spreads. FXOpen offers 50 currency pairs for trading. Keep in mind that Major pairs such as EUR/USD, EUR/JPY, GBP/USD, and others are more liquid than minor and exotic ones.

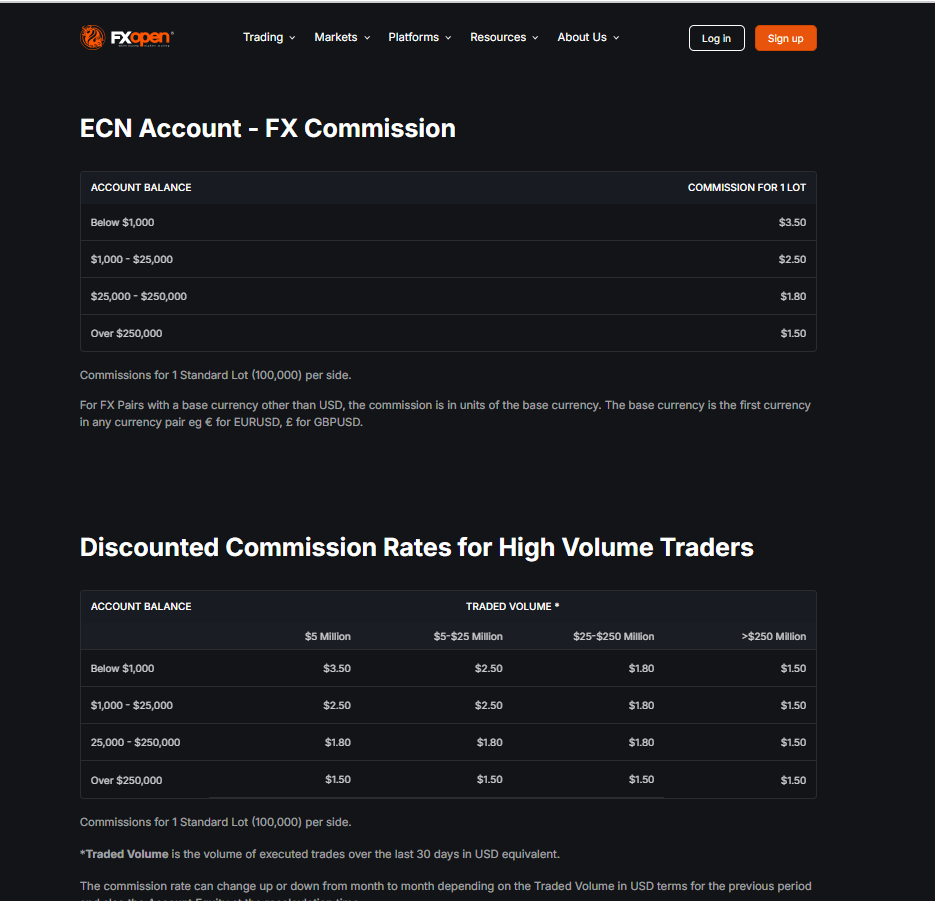

The commission per standard lot starts from $1.5 on an ECN account and the spreads are starting from 0. The leverage offered goes up to 500:1. Be aware that high leverage can be dangerous and result in a fast decline of your account balance or fast growth.

Stock CFDs and ETFs

The broker provides access to various stock CFDs and ETFs. CFDs are short for Contract for Difference and they are mostly traded by short-time speculators due to affordable fees and simpler access. Long-term investors prefer real stocks to stock CFDs.

With the FXOpen ECN account, traders can speculate on famous company prices such as Apple, Tesla, Microsoft, Amazon, Netflix, Citigroup, NIKE, and more. More than 600 single-stock assets are available.

For trading ETF CFDs, offered leverage goes up to 5:1. Commission for trading stocks is 0.1% and the broker offers up to 50 levels of market depth. This means you’ll be able to see your limit orders inside the order book.

Cryptocurrency CFDs

There are 43 cryptocurrency pairs to choose from when trading using the dedicated Crypto account. The list includes BTC/EUR, BTC/USD, BTC/JPY, LTC/USD, ETH/EUR, EOS/USD, NEO/BTC, and more. What’s more, you can trade cryptos 24/7, whereas Forex markets are only open 24/5.

Spreads start from 1 pip. Stop Out level for the 3:1 leverage account is 15%. As for the 1:10 leverage account, the Stop Out level is 50%. When your margin reaches a predetermined amount, brokers automatically close out your open positions in order to protect your balance from going negative. The swap rate is 10% per annum of your open position. Swaps are fees that are incurred whenever your open position is moved to the next trading session.

Indices

Indices are a good indicator of the health of certain industries and economies. For instance, the Australia 200 index consists of the top 200 Australian publicly traded companies. The index measures the collective performance of the stocks. Most traders use indexes as technical indicators when predicting future prices. In addition, you can trade indices as CFDs.

There are 13 indices available for trading with FXOpen. The list includes UK100, US Tech 100, Wall Street 30, Europe 50, France 40, Australia 200, Hong Kong 50, Japan 225, US SPX 500, and Germany 40. The Indices are accessible via MetaTrader and TickTrader platforms. The maximum leverage varies depending on the index and goes up to 100:1.

Commodities

Commodities are raw materials that are turned into consumer goods later. FXOpen provides access to trading CFDs on precious metals and energies. These include XAU/USD, XAG/USD, XBR/USD, XTI/USD, and US natural gas.Precious metals are immune to a lot of inflationary processes. Therefore, investors are using them as tools for hedging against inflation. However, CFDs are not particularly great for long-term investments. Energy prices such as natural gas and oil are affected by demand and supply. Disputes between countries, wars, developing renewable energy sources and other factors can influence energy prices.

The maximum leverage available differs for each asset.

- The leverage for trading gold and silver is up to 500:1

- US crude oil goes up to 50:1 leverage

- US natural gas goes up to 25:1

Account Types

Demo account

The demo account is very similar to the real account in terms of execution, pricing, and offered trading instruments. You can get familiar with the trading software, and develop, test, and improve trading strategies without the risk of losing real money. FXOpen offers two types of demo accounts, ECN and STP. You can choose from MetaTrader 4, MetaTrader 5, and TickTrader platforms.

FXOpen ECN demo account provides raw spreads from liquidity providers using electronic communication networks. As a trader, you can demo trade Forex pairs, crypto CFDs, metals, energies, stocks, and indices.The STP demo account includes the trading fees in the spread, access to the asset classes, and execution is no different from the ECN demo account.

Micro account

The FXOpen Micro account uses the Market Maker business model and not the true ECN/STP model. The Micro account is only offered by FXOpen Markets Limited to international traders.

The minimum initial deposit to open the account is only $1 and the maximum balance is $3,000. The leverage offered goes up to 500:1 and the Stop Out level is 10%. The account has floating spreads. On the downside, available assets for trading are limited to 28 currency pairs, gold, and silver.The account is great for testing your algorithms and trading strategies in a live trading environment without investing too much.

ECN account

ECN stands for Electronic Communication Network and describes the way FXOpen aggregates prices. The prices are raw and spreads are starting from 0 pips. The commission per 1 mil is $15 or in other words – $3 per standard lot (round-turn). The minimum initial deposit required to open the account is $100, with up to 500:1 leverage and a 50% Stop Out level. Traders have access to MetaTrader software and TickTrader.What’s more, you can trade 50 currency pairs, more than 25 crypto CFDs, stocks CFDs, indices, and commodities.

The ECN account is ideal for high-frequency and intraday trading, as well as algorithmic trading and scalping. Traders that open many orders per day prefer to pay less on spreads and more on commission.

STP account

The STP account offers access to fewer asset classes than the ECN account. You can trade 50 currency pairs as well as silver and gold, using only the MetaTrader 4 platform. The STP account is preferred by position traders as there’s no commission charged per lot traded. On the other hand, financial service provider fees are integrated into floating spreads.

Maximum leverage is 500:1 and the Stop Out level is 30%. The minimum initial deposit required to open the STP account is $10.

Crypto account

The Crypto account was specifically made for crypto CFD traders. The account provides access to trading 43 cryptocurrency pairs with BTC, LTC, EOS, PPC, ETH, DASH, and EMC using the MetaTrader 4 platform.The minimum initial deposit required to open the account is $10. Leverage goes up to 3:1 with a 15% Stop Out level. The business model is ECN, which means that the prices are raw, straight from the liquidity providers. Commission charged is 0.5% of trade volume (round-turn).

Islamic account

FXOpen offers Islamic versions of the ECN and STP account types. Note that the broker does not offer an Islamic crypto account type. Traders can contact the customer support of the broker and they’ll convert the account to Islamic. Islamic accounts are swap-free accounts that are compliant with Sharia laws. This enables Muslim traders to place orders without going against their beliefs.

Keep in mind that just because Islamic accounts are not charged with swaps doesn’t mean they are charged less. The account holders are charged additional commission fees. Therefore, at the end of the day, there’s no difference in terms of trading fees.

Fees & Commissions

Fees and commissions are affordable with FXOpen. The fees vary depending on the account type and asset class you choose to trade. In general, the broker offers low trading fees but the funding, deposit, and inactivity fees can be a turn-off for many traders. On the downside, STP account-type floating fees are not transparent.

Trading Platforms

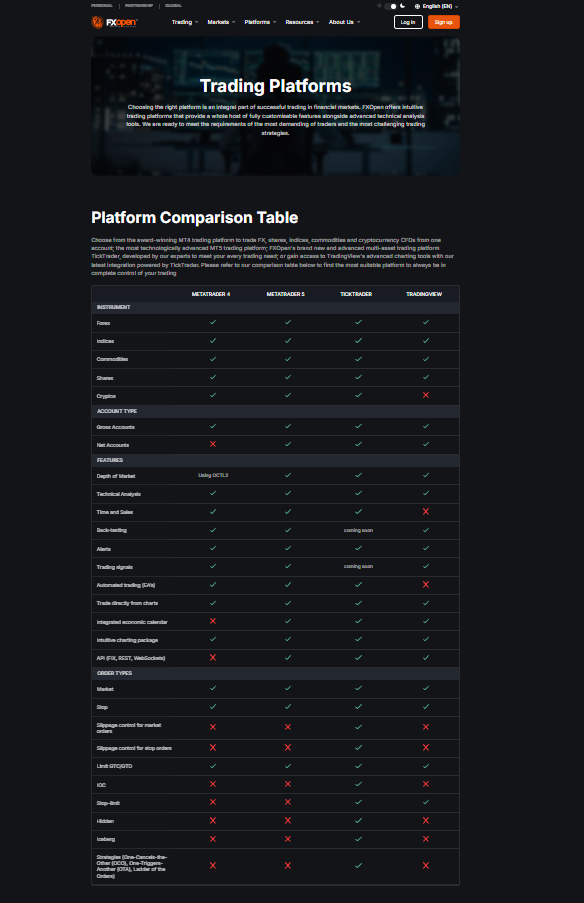

FXOpen provides MetaTrader software and TickTrader to its clients. The MetaTrader software was created by a Russian software company called MetaQuotes. MT4 was released in 2005 and has become dominant in the trading world due to its usability and simplicity. MT5 was released 5 years later and is more complex, offering access to a wider range of assets and more technical tools.

TickTraider comes with advanced technical analysis tools, a user-friendly interface, and level 2 pricing. The platform gives you the ability to see your order in the orders book. In addition, it gives you up to 200 levels of market depth. Which is particularly useful for trading stocks.

Mobile Experience

MetaTrader 4, MetaTrader 5, and TickTrader all offer mobile versions of the software. Mobile trading is very useful in the sense that it keeps you close to your trading. Monitoring, opening, and closing trades and checking the price become easier from anywhere in the world. The mobile apps provide all of the necessary features traders require to place orders, however, it’s recommended to analyze the markets using larger screens to process information better.

Education & Research Tools

Quality education is vitally important for novice traders when they are starting their careers. FXOpen is a true ECN/STP type broker, which means the broker is not interested in teaching you something that will cause you to lose money.

The broker provides extended tools for research such as an economic calendar, Forex market analysis, market news, blogs, forums, and trading contests. On the downside, the company lacks video guides and webinars.

Customer Support

The customer service provided by the broker is superb. The team of customer support agents is professional and very friendly. There are various ways you can contact the broker. You can send them an email, register a ticket and they’ll contact you, call them or chat with them online.

The live chat is accessible via Facebook Messenger, Telegram, Twitter, WhatsApp, Line, WeChat, and the broker’s main page. The agents don’t keep you waiting for long to start the conversation and resolve issues in a professional manner.