- No inactivity fees

- Offers access to MetaTrader 4, MetaTrader 5, and Multiterminal

- Fast and digital account opening/verification

- Offers access to trading Forex, commodities, indices, cryptocurrencies, Shares as CFDs

- Regulated in BVI, St. Vincent and the Grenadines

- Offers both spread markup and raw trading account with 0 spread markups

- Doesn’t offer physical shares

InstaForex is a multi-asset broker that provides access to trading Forex, commodities, indices, cryptocurrencies, and shares as CFDs. The broker offers various account types to meet the needs of different traders. There are no minimum initial deposit requirements and traders can start depositing from 1 USD.

InstaForex was founded in 2007 by the InstaFintech Group. Soon after its creation, InstaForex made contracts with MetaQuotes, the makers of the MetaTrader platforms. Even to this day, traders can pick MetaTrader 4, MetaTrader 5, or Multiterminal platforms for trading. The broker is authorized and regulated by various regulatory bodies, including regulators from the British Virgin Islands and St. Vincent and the Grenadines.

What makes this broker stand out from the competition is the number of awards received, starting from 2009. In 2022, the broker was awarded as:

- the Best Broker 2022 in Latin America according to International Business Magazine

- Best affiliate program 2022

- Best Forex Broker / International Investor Awards 2022

InstaForex Overview

| Regulations | BVI, St. Vincent and the Grenadines |

| Fees on deposits | 0 USD |

| Fees on withdrawal | 0 USD |

| Inactivity fees | 0 USD |

| Minimum deposit | 1 USD. Depends on the payment method |

| Minimum account activation | 1 USD |

| Number of available assets | 402. In addition, there are futures |

| Leverage up to | 1:1000 |

| Available trading markets | CFDs on Stocks, Commodities, Cryptocurrencies, Forex, Indices |

| Account currencies | EUR, USD |

| Demo account | Yes |

| Live account types | Insta.Standard, Insta.Eurica, Cent.Standard, Cent.Eurica |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 107 |

| Shares | 0 |

| Cryptocurrencies | 12 |

| Indices | 15 |

| Commodities | 9 |

| Total | 402 |

| Fees & spread | |

| Forex | From 3 pips On Standard accounts |

| Shares | N/A |

| Cryptocurrencies | From 0.1% |

| Indices | From 0.01 USD |

| Commodities | From 0 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5, Multiterminal |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | AstroPay, Bank Transfer, Credit/Debit Card, Crypto, Neteller, Skrill |

| Minimum deposit | AstroPay, Bank Transfer, Credit/Debit Card, Crypto, Neteller, Skrill |

| Minimum withdrawal | AstroPay, Bank Transfer, Credit/Debit Card, Crypto, Neteller, Skrill |

| Withdrawal processing time | Instant |

| Time to open an account | – |

Safety & Security

When it comes to selecting a CFD broker, the most important is safety and security. InstaForex is authorized and regulated by the Financial Services Commission (FSC) of the British Virgin Islands (BVI). InstaForex Global is registered by the FSC of Saint Vincent and the Grenadines. Both regulatory bodies are not very strict. As these are not the strictest regulatory authorities, as such, the level of security and safety is not tightly monitored with this broker.

Policies

In order to improve the safety and security of clients’ funds, InstaForex implements various policies. The broker is a member of the Investor Compensation Fund, which settles disputes between brokers and their clients. The maximum payable amount to be compensated is 20 thousand Euros. InstaForex also provides negative balance protection to retail traders, and traders get margin call emails at 30% and positions are liquidated automatically at 10% to prevent funds from going negative.

The broker keeps funds in segregated accounts, but not for all traders. To be eligible for account segregation, your balance needs to be at least 50,000 USD.

Trading assets

InstaForex provides access to 402 assets and all the assets are CFDs. CFD stands for “Contract For Difference”, and it’s the preferred option for those who are looking for speculative opportunities. You will not be able to find physical stocks, precious metals, or crypto tokens with this broker. However, CFDs are available for short to medium-term price speculations. When trading CFDs, you can use leverage to increase your purchasing power and traders can go short and make money in falling markets. When it comes to real shares, you can only make money by buying when prices are low and selling when markets are high.

Forex trading

There are 107 available currency pairs for trading with InstaForex. Traders can speculate on major, minor, and exotic pairs. Keep in mind that majors are the most liquid and minors are more liquid than exotics. Liquidity is essential as highly liquid assets will give you the best spreads. When it comes to trading fees, it all depends on your account type. Insta.Standard and Cent.Standard account types do not charge traders with commissions, however, spread markups start from 3 pips. The markups can be as high as 7 pips. When trading Forex using Insta.Eurica or Cent.Eurica account types, there are no spread markups, but trading fees range between 0.03%-0.07%. Available leverage is up to 1000:1.

Stock CFD trading

There are 402 available stocks as CFDs for trading with this broker. Trading fees start from 0.1% and the number of available stocks depends on the account type traders pick. Trading stocks as CFDs offers a number of benefits and drawbacks to trading with physical shares. Physical shares are less liquid than CFDs and there are more barriers to entering the market. On the other hand, real assets do not have rollover fees and are the best tools for investing long-term.

Available assets include popular company shares such as:

- Home Depot Inc

- Honeywell International Inc

- Horizon Therapeutics Plc Nasdaq Stock Exchange (Nasdaq) USD

- Howmet Aerospace Inc New York Stock Exchange (NYSE) USD

- IBM Corporation

- IQVIA Holdings Inc New York Stock Exchange (NYSE) USD

- IVERIC bio Inc.

- Illumina, Inc.

- Intel Corporation

Crypto CFD trading

There are 12 crypto CFDs available for trading with InstaForex. When trading the contracts for difference, you don’t need to worry about where to store the tokens or how to cash out as profits are added straight to your account balance. In addition, you can go long or short and make money in both bull and bear markets. Trading fees for all crypto pairs are 0.1%. InstaForex offers popular crypto CFDs for trading, such as:

- Bitcoin Cash vs USD – BCH/USD

- Bitcoin

- Cardano vs USD

- Chainlink vs USD

- Doge vs USD

- Ethereum vs USD

- Filecoin vs USD

- Litecoin vs USD

- Polkadot vs USD

- Ripple vs USD

- Solana vs USD

- Uniswap vs USD

Commodity CFD trading

There are 9 available commodities for trading with this broker. Available markets include Brent and crude oil, palladium, gold, silver, etc. Commodities are raw materials and their prices change based on global demand and supply. Even if you are only planning to trade currencies, it’s best to keep an eye on commodities as well. Some currency prices are highly correlated with things like oil producers and the like. For instance, the Canadian dollar is highly correlated with oil prices as Canada is one of the largest producers of oil in the world.

Indices trading

There are 15 available indices for trading with InstaForex. Indexes follow the performance of a basket of stocks, and as a result, they are great instruments not only for trading as CFDs but for measuring the strength of certain economies and industries. For instance, the S&P 500 or US500 follows the top 500 US companies which can be a good indication of the economic performance of the US economy.

Available indices for trading are:

- Amsterdam Exchange Index

- Deutsche Akzien Index

- Dow Jones Industrial Average

- Euro Stoxx 50 Index

- #STOXX50

- FTSE 100

- France 40 Index

- Hang Seng Index

- Italy 40 Index

- NASDAQ 100 Index

- Nikkei 225

Account types

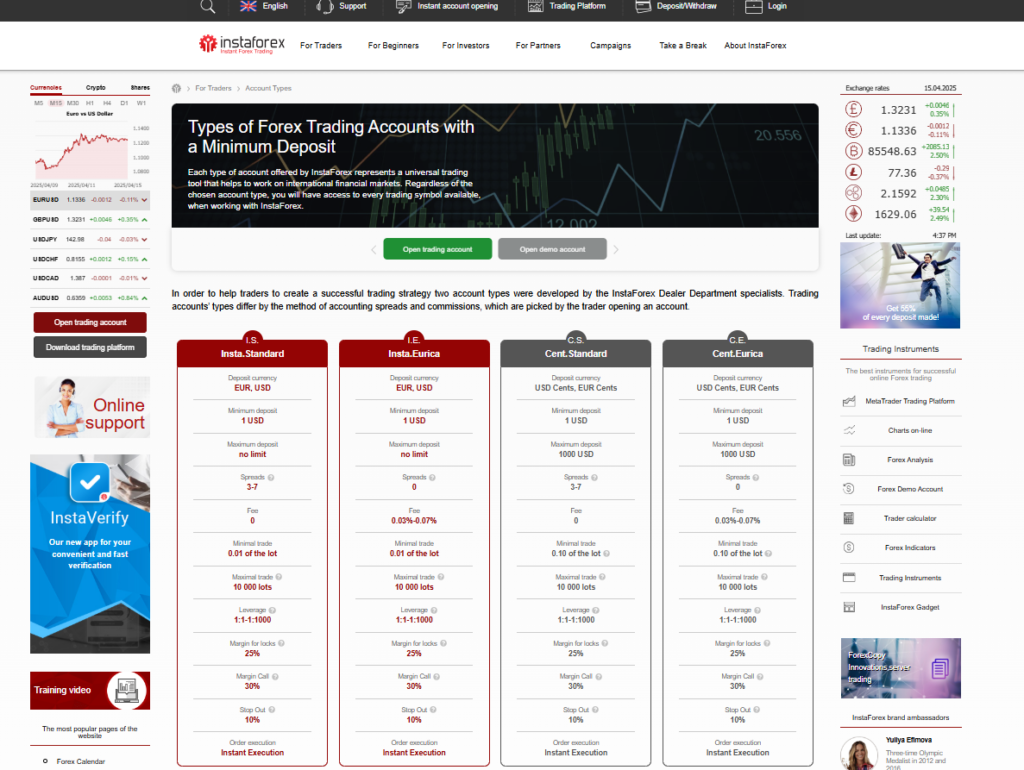

There are all kinds of traders in the market. Some trade more frequently such as intraday traders, high-frequency traders, scalpers, and news traders; while others trade less often, such as position traders and swing traders. Because of this, traders have different preferences when it comes to picking trading accounts. In order to meet the needs of various trader types, InstaForex provides four different account options: Insta.Standard, Insta.Eurica, Cent.Standard, and Cent.Eurica.

Demo Account

InstaForex enables traders to open demo accounts for free. Demo trading is very similar to live trading with one major difference; the funds you use are not real. Therefore, traders get the opportunity to learn how to use indicators, how to open and close trades and analyze markets without risking their capital. Professional traders use the Demo account to improve their trading strategies. Some traders switch to demo trading during drawdown periods, building their confidence back before returning to trading live.

Insta.Standard Account and Cent.Standard Account

The standard trading accounts are very similar. The main difference is that the Cent.Standard account is for traders that wish to test live trading without taking large risks. Usually, traders transition from demo accounts to the cent accounts to experience live execution, test the performance of trading robots, etc. in a way that puts them in the midst of the action without risking too much. The maximum available deposit on both Cent.Standard and Cent.Eurica accounts is 1,000 USD. Available leverage is up to 1000:1 and Stop Outs get activated at 10% of the margin.

There are no commissions on Standard accounts. However, spread markups range between 3 and 7 pips.

Insta.Eurica Account and Cent.Eurica Account

The Eurica account holders are not charged with spreads. On the other hand, there are 0.03%-0.07% trading fees. With the Cent.Eurica account’s maximum available deposit is 1,000 USD, with available leverage of up to 1000:1. The account types are attractive to traders that open many orders each day, such as intraday traders, high-frequency traders, algorithmic traders, scalpers, news traders, etc. Margin call emails are sent at 30% and Stop Out orders get activated at 10%.

Fees & commissions

Trading fees of InstaForex are higher than the competitors. Most other brokers offer around 1 pip markups while the Insta account offers from 3 to 7. One good thing that is good about InstaForex is that there are no inactivity fees or deposit and withdrawal fees. What’s more, both spread-free and commission-free accounts are available. Let’s compare the fees of InstaForex with other brokers to better understand the broker’s policies. For this comparison, we picked standard account fees with 3-7 spread markups and no commissions.

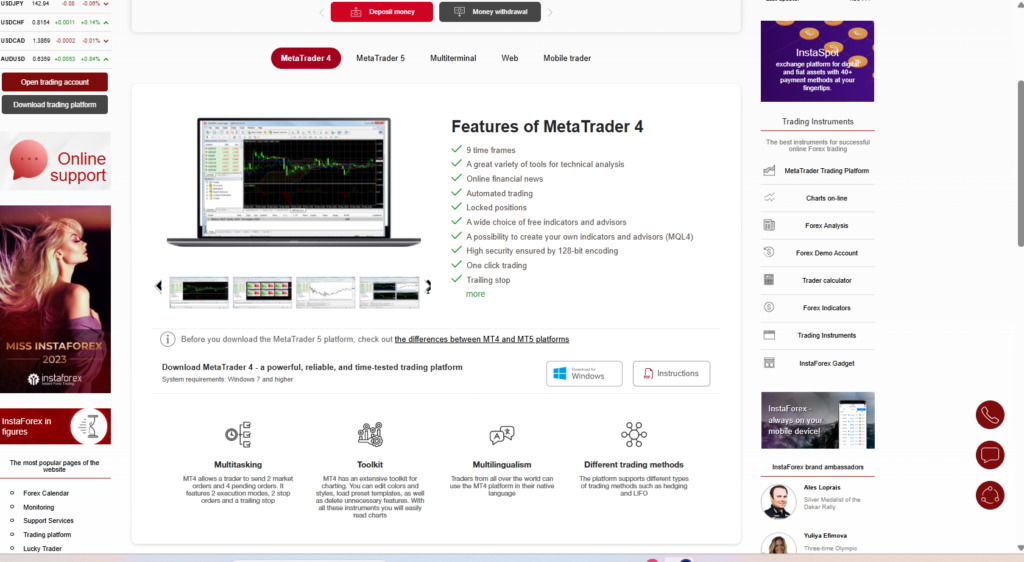

Trading platforms

Broker offers the full set of MetaTrader platforms and the Multiterminal that is made for money managers that trade using various accounts and platforms. The main platforms that traders can install on their personal computers are MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT5 is a bit more complex, offering:

- 21 time frames

- Market Depth (Level II pricing)

- MQL5 – programming language for designing Expert Advisors or EAs for short, and indicators.

- Quotes archive

- An advanced set of technical tools

- Expiry dates for pending orders

- In-built Expert advisors, indicators, and scripts

MT5 was built for trading various asset classes, including Forex, commodities, indices, cryptocurrencies, shares, bonds, and futures, while MT4 was built for mainly trading Forex pairs.

MT4 is simpler than MT5 and is often the first choice for FX traders. The platform offers:

- 9 time frames

- A variety of tools for technical analysis

- Online financial news

- Automated trading using EAs

- Locked positions

- A possibility to create your own indicators and advisors using MQL4 programming language

- High security ensured by 128-bit encoding

- One-click trading

- Trailing stop

Mobile Trading

InstaForex provides access to both mobile apps and a web trading terminal. The mobile app enables traders to view live charts, place different order types, and monitor trades. Mobile versions of MetaTrader 4 are available in both Google Play and the Apple App store. App trading is an essential tool for dealing with emergency situations such as internet problems, power outages, etc.

Education and research tools

InstaForex provides extensive material for both beginners and experienced traders. The educational material is available from the broker’s home page under the “For Beginners” section and includes:

- Training

- Trading Platform guides

- FAQ

- How to start trading articles

- Video Tutorials

- Forex explanatory articles

- Forex Glossary

For more seasoned traders, there are tools for market analysis, including:

- Chief Strategist analysis

- Analytical Reviews

- Economic Calendar

- Holidays worldwide

- Video analytics

- InstaForex TV

- Trading Sessions

- News in pictures

Overall, we can safely say that the educational material is of decent quality and very extensive.

Customer support

Great customer service is the most important aspect of every financial services provider. InstaForex provides customer service 24/7 which is fantastic as most competitors are only available 24/5. Traders can contact the broker using email, via live chat, or over the phone. The customer support agents are professional and super friendly. Overall, the customer service provided by this broker is great.