- No inactivity fees

- Offers access to MetaTrader 4, MetaTrader 5

- Fast and digital account opening/verification

- Offers access to over 1,000 trading assets

- Regulated in Australia, South Africa, St. Vincent and the Grenadiness, professional trading insight, and code-free automation.

- 100 USD or more is required to open an account

VT Markets is a global multi-asset CFD broker. The company was founded in 2015 and since its creation has managed to collect more than 200,000 active traders. The broker executes more than 4 million trades per month and the monthly trade volume is often reaching over the 200 billion USD level.

VT Markets is authorized and regulated in various jurisdictions, including Australia and South Africa, as well as in St. Vincent and the Grenadines.

The broker provides access to trading various asset classes: Forex, commodities, indices, and shares as CFDs. What sets this broker apart from others is that it offers around 800 global shares as CFDs.

VT Markets Overview

| Regulations | Australia, South Africa, St. Vincent and the Grenadines |

| Fees on deposits | $0 |

| Fees on withdrawal | $0 |

| Inactivity fees | $0 |

| Minimum deposit | $100 |

| Minimum account activation | $100 |

| Number of available assets | 1000 |

| Leverage up to | 1:500:1 |

| Available trading markets | Forex, Commodities, Indices, CFDs on Stocks |

| Account currencies | 5EUR, USD, GBP, AUD, CAD |

| Demo account | Yes |

| Live account types | 3 |

| Islamic account | Yes |

| Security | |

| Negative balance protection | Yes |

| Part of compensation fund | Yes |

| Keeps funds on segregated bank account | Yes |

| Assets | |

| Forex | 49 |

| Shares | |

| Cryptocurrencies | 23 |

| Indices | 24 |

| Commodities | 22 |

| Total | 1000 |

| Fees & spread | |

| Forex | From 1.2 |

| Shares | From 0 |

| Cryptocurrencies | N/A |

| Indices | From 0.1 |

| Commodities | From 0.056 |

| Software | |

| Platforms | MetaTrader 4, MetaTrader 5 |

| Mobile trading support | Yes |

| Mac device support | Yes |

| Commodities | Yes |

| Payment systems | |

| Payment methods | Bank Transfer, Credit/Debit Card |

| Minimum deposit | – |

| Minimum withdrawal | – |

| Withdrawal processing time | Up to 1 Business day |

| Time to open an account | 2 |

Safety & Security

When it comes to safety and security of traders’ funds, the most important indicator is regulations. In order for the broker to be deemed trustworthy, it needs to be authorized by well-established regulatory bodies.

VT Markets is authorized and regulated by:

- Australian Securities and Exchange Commission ASIC

- Financial Sector Conduct Authority FSCA, South Africa

- Financial Services Authority of St. Vincent & the Grenadines

Policies

VT Markets offer account segregation and negative balance protection for a start. CFD trading can result in losing more money than what’s on the trading balance. The reason is simply that when traders are using leverage, they are lending money from their broker to increase purchasing power. Consequently, when market conditions are not favorable and the order size is too large, traders can end up owing money to their broker. VT Market guarantees that the balance will never go negative by implementing Stop Out Levels.

In addition, your money is held in segregated accounts. This is important, as even if the broker goes bankrupt, your funds are safe.

Trading assets

Forex trading

VT Markets offers 49 available currency pairs including major, minor, and exotic ones. Major currencies are the most liquid and have the tightest spreads. Spreads not only depend on the market conditions but the account type you choose. The broker has spread-free and commission-free accounts, and fees for trading currencies vary. We’ll expand more on that in this review later. Leverage for trading currencies is up to 500:1.

Stock CFD trading

VT Markets offers around 800 stocks as CFDs. You can find UK, US, EU, and HK company stocks to choose from. Trading stocks as CFDs are best for short-term speculating, but not a good idea for long-term investing. Long-term investors purchase physical stocks to avoid swaps and overnight trading fees. VT Markets has one of the largest asset offerings when compared to its competitors.

Indices trading

Indices are indexes of a certain basket of publicly traded stocks. For instance, the US30 or Dow Jones index includes 30 top American companies. The index follows the performance of its basket stocks and therefore, many traders and economists use indices as an indication of economies or industries’ health. Indices can also be traded as CFDs. VT Market offers access to 24 indices. The list includes: DAX40, CHINA50, SP500, FRA40, etc.

Commodity CFD trading

Commodities are raw materials. These materials are either grown (soft) or mined (hard). VT market offers 22 commodities as CFDs. Including hard commodities such as energies and precious metals (gold, silver, platinum, etc.).

In addition, you can also trade soft commodities:

- Cocoa

- Coffee

- Cotton

- Orange juice

- Raw sugar

Keep in mind that the commodity prices are affected by global demand and supply. In addition, trading these instruments as CFDs enables you to use leverage and trade both bull and bear markets to profit from market fluctuations in both directions.

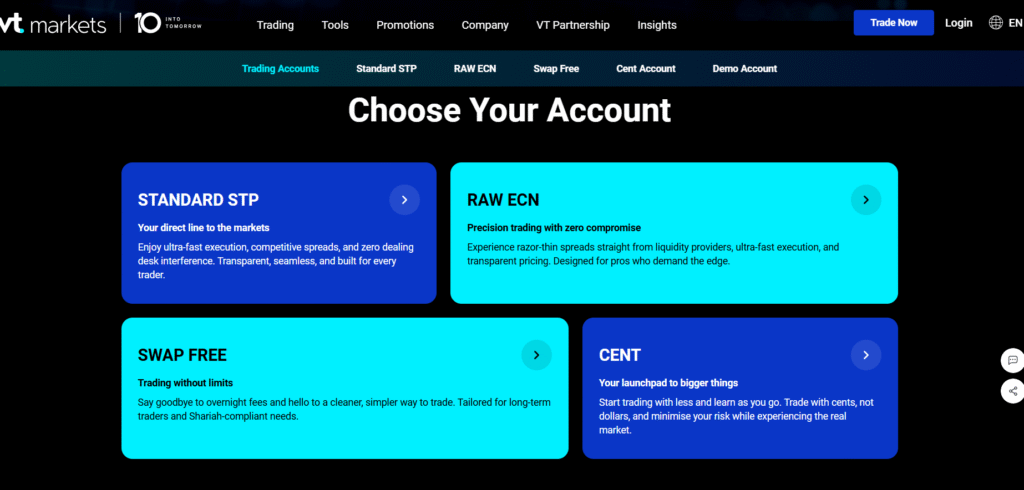

Account types

There are various types of traders in the market. There are a million different ways to make money, but unfortunately, all of them are hard to find. Even if you are using a profitable system, it doesn’t mean you are a profitable trader. The trading system needs to be suitable to your personality and style in order for it to work. To meet the needs of different trader types, VT Markets offers spread-free and commission-free accounts. Let’s discuss them in detail.

Demo Account

Demo trading simply means that you are in a simulation that uses live trading data. Traders experience live environments without risking actual money. On the other hand, some traders find it difficult to stay motivated in front of their PC screens, knowing that real money will not be earned at the end of the day. However, demo accounts are essential in developing a good trading style.

The Demo account has numerous uses. Demo accounts are great if you are evaluating broker policies and offerings. In addition, the account type helps beginners get accustomed to trading platforms and indicators, while more seasoned traders use demo accounts for developing and testing trading strategies.

Standard STP Account

The Standard account is for beginners and traders who like to put more thought into making a trade. There are no commissions, but traders are charged 1.2 pips spread markups. Available leverage is up to 500:1. The minimum initial deposit required to open an account is 100 USD. The available platforms are MetaTrader 4 and MetaTrader 5. The orders are executed using STP (Straight Through Processing), which means that the orders are directly sent to the market and there are no dealing desks involved.

RAW ECN Account

The RAW ECN account is for more seasoned traders that trade intraday as there are 0 spread markups. On the other hand, there’s a 6 USD commission per lot round turn. The order execution type is ECN (electronic communication network). The ECN execution brings lower trading fees. Similarly to the STP Account, available leverage is up to 500:1, and the minimum initial deposit required to open an account is 100 USD. The available platforms are MetaTrader 4 and MetaTrader 5.

Fees & commissions

Trading fees of VT Markets are reasonable. There are spread-free and commission-free account types to choose from, which is very beneficial for various trader types. What’s more, there are no inactivity and transaction fees from the broker’s end.

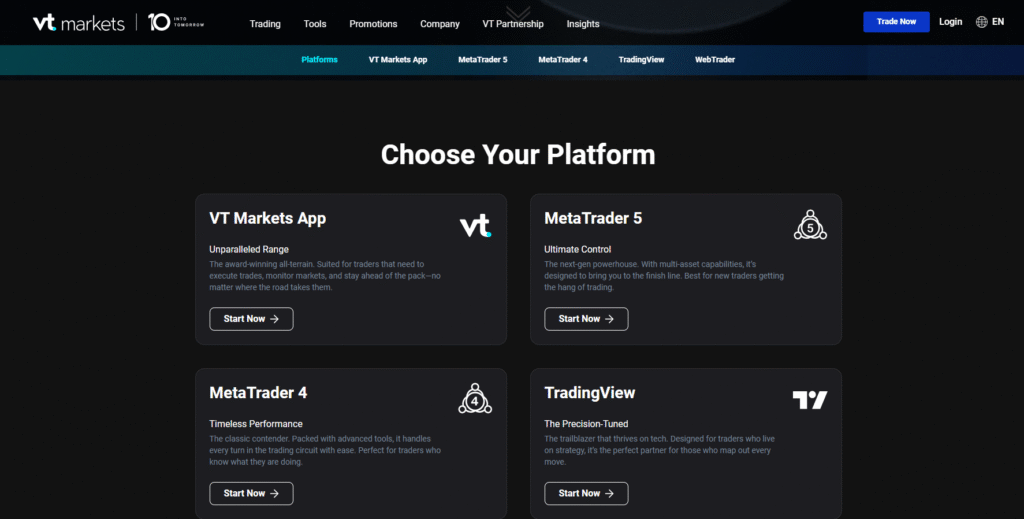

Trading platforms

VT Markets offers the full set of MetaTrader platforms, i.e MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and they are built by a Russian software giant, MetaQuotes inc.

MetaTrader 4 was released in 2005 and has gained popularity almost instantly. MT5 was released 5 years later in 2010. The MetaTrader programs have not had any major graphical upgrades since their launch, as a result, they may seem outdated with the old design. However, these platforms are dominant even today due to their ability to reliably execute trades.

Initially, the MT4 platform was designed for trading FX pairs and still remains a major platform for trading currencies. For trading, various asset classes such as shares, FX, commodities, indices, and bonds, MetaTrader 5 is the one to pick.

Mobile Trading

The mobile app offered by VT Markets has all the necessary features traders need to manage their trades from anywhere in the world. The app is accessible for both Android and iOS devices. The app is extremely helpful in emergency situations such as power outages, loss of internet connection on your computer, etc. In addition, the mobile app can be used for deposits and withdrawals and for executing various trade orders.

Education and research tools

Education and research tools are especially important for beginner traders. VT Markets offers extensive material in this regard.

Traders can use the following trading tools:

- Expert advisor

- Forex signals

- Economic calendar

- Trading Central

- MT4 tools

- Forex calculators

- MAM/PAMM

In addition, there is daily market analysis available. Moreover, traders have access to educational videos and MT4 guides. Furthermore, there is the Learn Forex tab under which there are explanatory articles for beginners.

Customer support

VT Markets provides 24/5 customer support in multiple languages, and most European and Asian countries are covered. What’s more, there are MENA languages available on the webpage for middle-eastern clients. Traders can contact the broker using a live chat, email, or over the phone. Customer support agents are well-trained and very friendly. Overall, the customer support at VT Markets is good.